Recensione del broker Trade Nation

| 🏦 Deposito Minimo | USD 5 |

| 🛡️ Regolamentato da | FCA, ASIC, FSCA, SCB |

| 💵 Costo di Trading | USD 6 |

| ⚖️ Leva massima. | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Piattaforme | MT4, Cloud Trade |

| 💱 Strumenti | Obbligazioni, Materie prime, Criptovalute, Energie, Stock CFDs, Forex, Future, Indices, Metalli |

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su Trade Nation

A well-regulated broker with excellent trading conditions on one live account, Trade Nation appeals to traders who prefer the predictability of fixed spread trading.

A market maker, Trade Nation offers support for MT4 and its own proprietary Trade Nation platform. With one live commission-free account, Trade Nation’s highly competitive spreads are fixed at 0.60 pips on the EUR/USD and there are no minimum deposit requirements. Additionally, Trade Nation’s non-trading fees are low – there are no inactivity fees and deposits and withdrawals are free of charge.

Trading is offered on an average range of assets compared to other similar brokers, including Forex, indices, futures, metals, energies, bonds, and share CFDs, but no cryptocurrencies.

Trade Nation’s customer support features platform walk-throughs and help with setting up accounts, but its live chat feature is often unresponsive. Another drawback is the lack of educational materials, forcing traders to self-educate elsewhere, but its market analysis is decent.

| 🏦 Deposito Minimo | USD 5 |

| 🛡️ Regolamentato da | FCA, ASIC, FSCA, SCB |

| 💵 Costo di Trading | USD 6 |

| ⚖️ Leva massima. | 200:1 |

| 💹 Copy Trading | No |

| 🖥️ Piattaforme | MT4, Cloud Trade |

| 💱 Strumenti | Obbligazioni, Materie prime, Criptovalute, Energie, Stock CFDs, Forex, Future, Indices, Metalli |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Spread stretti

Controindicazioni

- Opzioni di account limitate

- Account demo limitato

- Nessuna opzione di conto swap-free

Is Trade Nation safe?

Trade Nation is a safe broker to trade with. It maintains regulation from two top-tier authorities, including ASIC of Italia and the FCA of the UK, the FSCA, and it is regulated by the SCB of the Bahamas.

Founded in 2020 and headquartered in the United Kingdom, Trade Nation is regulated by various top-tier authorities including the Financial Conduct Authority (FCA), the Deutsch Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of the Bahamas. It is also fully compliant with the European Securities and Markets Authority (ESMA). See the following list of Trade Nation registered companies:

- Trade Nation is a trading name of Finsa Europe Ltd, a financial services company authorised and regulated by the Financial Conduct Authority under firm reference number 525164.

- Trade Nation is a trading name of Finsa Pty Ltd, a financial services company authorised and regulated by the Deutsch Securities and Investments Commission, ACN 158 065 635, AFSL No. 422661.

- Trade Nation Financial (Pty) Ltd, registration number 2018/418755/07, is authorised and regulated by the Financial Sector Conduct Authority, FSP No 49846.

- Trade Nation Ltd, registration Number 203493 B, is authorised and regulated by the Securities Commission of the Bahamas, SIA-F216.

In early 2021, ASIC tightened its restrictions on CFD trading to better protect traders. As a result, Trade Nation clients in Italia will have a leverage limit of 30:1 for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. In addition, ASIC regulations ensure that Trade Nation keeps its operational funds segregated from client accounts, but also prevent Trade Nation from offering promotions or bonuses.

While the additional protection offered by ASIC regulation is welcome, some traders may find the low leverage levels and lack of bonuses at Trade Nation restrictive. The only way around these restrictions is to trade with a broker which does not have ASIC regulation, which of course then means less protection.

Overall, because of its long history of responsible behaviour, strong international regulation, and provision of negative balance protection, we consider Trade Nation a safe broker to trade with.

Trading Fees

Trade Nation’s Forex trading fees are significantly lower than other similar CFD brokers.

There is no account choice at Trade Nation, which is unusual as most of its serious competitors have several account types with tighter spreads linked to higher deposit requirements. Click here for more details on Trade Nation’s single account.

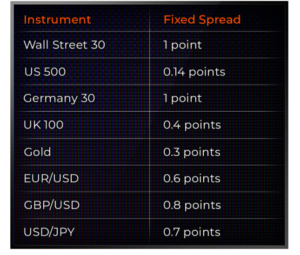

Unlike other brokers that offer variable spreads which tighten or widen depending on trading volume and market volatility, Trade Nation offers fixed spread accounts.

Trade Nation’s account was assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

At a trading cost of 6 USD per lot of EUR/USD traded, Trade Nation’s fees are significantly lower than other brokers. Most other brokers have a trading cost of 9 USD per lot traded.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. In most cases, interest is paid (or received) for each night a position is held. Trade Nation does not charge a swap fee on its proprietary CloudTrade platform. It does, however, charge the LIBOR rate plus an additional interest rate of 2.5%. The London Interbank Offered Rate (LIBOR) is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

For example, on a long position: Say 1-month LIBOR is 1.25%, Trade Nation calculates the interest rate by adding 2.5% to 1.25% totalling 3.75%.

On a short position: When the 1-month interbank rate is below 2.5%, this percentage is debited from your account instead. So, if the one-month LIBOR is 1.0%, Trade Nation subtracts this from the 2.5% charge, meaning the overnight interest rate will be 1.5%.

It is slightly different when trading with Forex:

Trade Nation uses the difference between the interest rate of the first currency and the second, then applies its charge of 2.5%.

Using the USD/GBP currency pair as an example:

If the USD interest rate is 5% and GBP’s is 1% then the difference is 4%.

If you had bought a position of USD/GBP: You will be credited 4% minus Trade Nation’s 2.5% charge for each day you hold the position after 10 pm London time.

If you had sold a position of USD/GBP: You would be charged 4% plus Trade Nation’s 2.5% charge for each day you hold the position after 10 pm London time.

Overall, Trade Nation offers some of the lowest trading fees in the industry and offers fixed spreads, which means that costs remain low even during times of high market volatility. While no swap fees are charged, the LIBOR rate plus 2.5% is charged for positions held overnight.

Non-trading Fees

Trade Nation’s non-trading fees are lower than other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Trade Nation charges no inactivity fee, there is no account fee, and deposit and withdrawal options are also free of charge.

Trade Nation also does not charge any additional currency conversion fees.

Overall, this is a welcome development in an industry that charges fees on most transactions.

Opening an Account at Trade Nation

The account opening process at Trade Nation is fully digital, fast, and hassle-free compared to other brokers.

All traders are eligible to open an account at Trade Nation but will have to follow the fully digital application process.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready within one day. Trade Nation offers joint and individual accounts, but we will focus on opening an individual account:

How to open an account at Trade Nation:

-

New traders will have to click on the “Join Us” button at the top of the page where they will be directed to fill in their name, email address, and register a password.

-

Next, traders will have to confirm their country of residence and select their level of trading experience.

-

Traders can then choose to open a live account or a demo account.

-

Traders will have to fill in their date of birth and detail their level of trading experience and financial status.

-

Trade Nation’s intake form requires clients to fill in their personal details, including physical address, mobile number, identity number, and choose their preferred trading account currency.

-

Prospective traders are then required to review the account application details.

-

Traders will then have to accept that they have read the Client agreement, Risk Disclosure Notice, and that they understand the risks involved in leveraged trading.

-

Once this step is complete, Trade Nation will verify all documents and notify traders via email should they require more information.

-

Trade Nation needs at least two documents to accept you as an individual client:

-

Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of your passport. If no valid passport is available, a similar identification document bearing your photo such as an ID card or driving licence will work.

-

Proof of Address – a Bank Statement or Utility Bill. Please ensure, however, that the documents provided are not older than 6 months and that your name and physical address are clearly displayed.

-

-

Once the application is approved, traders can log in and fund their accounts.

Compared to other similar brokers, Trade Nation’s account opening process is fast, generally hassle-free, and fully digital, and accounts are ready for trading in one day.

Trade Nation’s Trading Accounts

Trade Nation offers one live account, which is limited compared to other brokers, but its account is suitable for both beginners and more experienced traders.

A market maker, Trade Nation offers one live account on its proprietary Cloudtrade platform and MT4 (although we couldn’t find details regarding the trading conditions on MT4). Trading is offered on multiple assets, including Forex, indices, energies, metals, futures, bonds, and equities (click here for more on Trade Nation’s financial assets).

Trade Nation’s account has no minimum deposit requirement and offers smaller trade sizes (0.1 lots), making it suitable for beginner traders.

We define beginner traders are inexperienced traders who have never traded before, or who have been trading for less than a year. Beginner traders often do not want to risk trading large sums of money and generally will not be able to trade full-time during the workweek.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. However, at Trade Nation, this trade-off does not occur, as there is only one live trading account, but with excellent trading conditions.

traders can access maximum leverage of up to 200:1 and while Trade Nation allows hedging and scalping, it does not support copy trading. Additionally, Trade Nation does not offer Islamic swap-free accounts. See below for account details:Retail Account

A market maker, Trade Nation’s retail account is commission-free and has spreads that are fixed at 0.60 pips on the EUR/USD, which is highly competitive. However, traders should note that between 22:00 and 23:00 (GMT+1), spreads rise to 1.4 pips on the EUR/USD. There are no minimum deposit requirements to open an account.

Demo Accounts

Trade Nation offers a free demo account called the practice platform, where customers can test out trading strategies with 10,000 USD in virtual funds. Practice accounts last for 500 trades. The broker also offers a one-to-one walkthrough with the demo account, which can be requested via a callback service on the website.

Deposits and Withdrawals

Trade Nation offers a limited range of funding methods compared to other similar brokers, but both deposits and withdrawals are free of charge.

A well-regulated broker, Trade Nation ensures that all anti-Money Laundering rules and regulations are followed, and as such all withdrawals are returned to the deposit source.

Traders can deposit money via debit cards, credit cards, bank transfers, and Skrill. Deposits and withdrawals are free. See the following list of methods for withdrawals and deposits:

- Visa/Mastercard: Deposits are instant, but withdrawals may take up to 5 days to reach one’s account.

- Bank Transfers: Deposits can take three days to be processed, withdrawals take up to 5 days to reach one’s account.

- Skrill: Deposits are instant, but withdrawals may take up to three days to be processed.

Overall, Trade Nation offers a limited number of funding and withdrawal methods, and while no commissions are charged, withdrawal times are slow.

Base Currencies (Trading Account Currencies)

Trade Nation offers trading in 8 base currencies, an average range compared to other forex brokers, and offers accounts denominated in AUD.

Trade Nation offers a reasonable range of base currencies, including USD, AUD, GBP, NOK, SEK, DKK, ZAR, and EUR, which is good for Deutschs who will likely have AUD bank accounts. Deutsch traders will therefore be able to avoid paying conversion fees, unless trading on instruments with other base currencies, such as the EUR/USD.

In this case, it is better for traders that trade in large volumes (more than 10 lots a month) to open an account denominated in USD at a digital currency bank. This is because when trading a USD quoted currency pair with an AUD account, there will be a small conversion fee for every trade made.

Overall, Trade Nation offers an average range of base currencies compared to other brokers and offers accounts denominated in AUD.

Trading Platforms

With support for its own proprietary platform and MT4, Trade Nation’s platform support is average compared to other similar brokers.

Trade Nation offers support for its proprietary Trade Nation platform and MT4, available on PC and web browser.

Trade Nation Platform

Trade Nation prides itself on its bespoke trading platform. According to the broker, it features everything traders need and nothing they do not. The platform looks fantastic, is very easy to use, and has a solid reputation in the trading community. Exceptionally, it is available in over 13 languages.

The bespoke platform is intuitive and provides flexible charting functionality through a sleek user interface. 12 interactive graph types are available such as histograms and candle charts, and it’s also easy to overlay information on graphs, with a good selection of drawing tools available. The optional deal button in the chart view means trades can be executed quickly. The chart supports scores of technical indicators and time frames. An impressive number of drawing tools are also available. Launching trades is possible directly from the charts.

However, unlike platforms such as MT4 and MT5, the platform is not customisable, and traders who are used to setting up their own charts over a bespoke workspace will be disappointed. In addition, the platform does not offer the execution speeds of the Metatrader platforms, nor does it offer algorithmic trading.

Metatrader 4

While not the most beginner-friendly software, MT4 has been the industry-standard platform for trading Forex and CFDs since 2005. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. Features of the MT4 include:

-

A built-in library of more than 50 indicators and tools to streamline the analysis process.

-

An impressive array of analytical tools, available in nine timeframes for each financial instrument.

-

Live price streaming on live accounts and demo accounts 128-bits encryption for secure trading

-

Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

-

Customisable alerts

-

Access to MetaTrader market and MQL4 community

Mobile Trading App

Trade Nation’s mobile platform support is average compared to other similar brokers.

The Trade Nation platform and MT4 are both available on both Android and iOS.

Trade Nation Platform

Trade Nation’s mobile trading platform has all the same features as the desktop version, but it is only available in English and traders cannot set mobile alerts.

MT4

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

Trade Nation’s trading tools are limited compared to other brokers.

Unlike other similar brokers, Trade Nation does not offer any additional sentiment indicators or automated analytics services such as Autochartist or Trading Central.

It does offer Smart News, but this will be discussed in the market research section.

Trade Nation’s Financial Instruments

Trade Nation offers an average number of tradable assets compared to other large international brokers.

Trade Nation’s range of financial instruments for CFD trading includes Forex, share CFDs, futures, metals, energies, and bonds (click here for more details on CFD trading):

-

Forex: Trade Nation has 33 currency pairs available for trading, a slightly limited range compared to other CFD brokerages, but these include majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

-

Share CFDs: Trade Nation offers 1100 share CFDs, a much broader range than is typically found at other brokers, including the UK100, and the top US, European and Deutsch exchanges. Traders should note that share CFD trading is only available on the Trade Nation platform.

-

Indices: Limited compared to other brokerages, there are only 23 indices available for trading at Trade Nation. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Energies: Trade Nation offers trading on 2 energies, a limited range compared to other brokers. These include Brent Crude Oil and US Light Crude.

-

Metals: Trade Nation offers trading on 7 rolling spot metals, a broader range than most other brokers. These include gold, silver, aluminium, lead, nickel, zinc, and copper.

-

Bonds: Trade Nation offers trading on 3 bonds. Bond CFDs give you the ability to trade the world’s most liquid, popular, and largest government bonds from the US, UK, and Europe.

Overall, Trade Nation offers a limited range of tradable instruments on MT4, but it offers a wider range of share CFDs than is typically available at other brokers. Additionally, Trade Nation no longer offers cryptocurrency trading.

Trade Nation for Beginners

As far as education goes, the broker does not seem to have anything special set up for its traders. It offers a training academy that covers the basics of trading in addition to video tutorials. Market analysis materials include news and analysis, in addition to an expert advisory section. However, Trade Nation offers a limited demo account (which expires after 500 trades), and customer service support is available 24/5 for all client-related and technical queries. Note that none of the materials are translated into Malay.

Educational material

Trade Nation’s educational materials are limited compared to other similar brokers.

Trade Nation’s trading academy offers a limited selection of beginner guides covering basic and advanced trading concepts, as well as news. It also offers helpful video tutorials on using the various trading platforms.

Market analysis Materials

Trade Nation’s market analysis materials are average compared to other large international brokers.

Trade Nation offers an up-to-date section in addition to expert advice on trading strategies. It offers real trading stories from members of its community, which is helpful for beginner traders. The broker also offers a Smart News section, which provides insights acquired from alternative, independent sources, including social media.

Customer Support

Trade Nation’s customer support is average compared to other brokers, but its live chat feature is often unresponsive.

Customer support is responsive and available 24/5 via telephone, email, and a call-back service. The customer support team is also available for one-to-one platform walkthroughs. Note that customer support is not available in Malay.

For the purposes of this review, we found the live chat service mostly unresponsive, however, our questions were eventually followed up on email. Additionally, the agents were unable to answer some of our questions. For example, they could not give us information on the MT4 spreads, nor why there is no information published about the MT4 platform.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of how we review Trade Nation’s product offering. Central to that process is the evaluation of the broker’s reliability, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Trade Nation would like you to know that: Financial spread trading comes with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread trading works and whether you can afford to take the high risk of losing your money.

Overview

A well-regulated market maker, Trade Nation offers excellent trading conditions, with low fixed spreads and no commissions on one live account. Full support is offered for the Trade Nation platform and MT4, although no details are published about MT4. Trade Nation also offers low non-trading fees and offers one-to-one walkthroughs of its demo accounts and trading platforms.

One drawback is the relative lack of educational materials on offer, forcing traders to self-educate elsewhere, but its market analysis is decent.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come Trade Nation si posiziona rispetto ad altri broker.