Recensione del broker MultiBank

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su MultiBank

A well-regulated broker with the largest number of CFDs in the industry, Multibank will appeal to experienced traders who prefer paying higher minimum deposits for tighter spreads and those looking to trade share CFDs from a wide range of global stock exchanges.

Multibank offers support for the MT4 and MT5 trading platforms in addition to a copy trading platform and a range of trading tools including free VPS hosting, MAM/PAMM accounts, and FIX API. Of the three account types on offer, its high deposit ECN account with tight spreads will appeal to more experienced traders.

Multibank offers trading on Forex, cryptocurrencies, commodities, metals, indices, and over 20,000 share CFDs, the largest set in the industry. A significant drawback for beginner traders considering MultiBank is the lack of educational and market analysis materials.

| 🏦 Deposito Minimo | USD 50 |

| 🛡️ Regolamentato da | ASIC, MAS, BaFin, B.V.I FSC |

| 💵 Costo di Trading | USD 15 |

| ⚖️ Leva massima. | 500:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | MT4, MT5, cTrader |

| 💱 Strumenti | Materie prime, Criptovalute, Stock CFDs, Forex, Indices, Metalli |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Ottima scelta di piattaforma

- Spread stretti

Controindicazioni

- Leva estrema

- Commissioni elevate

Is MultiBank Safe?

Yes, Multibank is a safe broker for s to trade with. It maintains regulation from some top-tier authorities, including ASIC of Italia, BaFin from Germany, the CNMV, the FMA of Austria, and the DFSA of Dubai.

Founded in 2005, and headquartered in Hong Kong, MultiBank is regulated by numerous top-tier authorities worldwide, including the Deutsch Securities and investments Commission (ASIC), the German Federal Financial Supervisory Authority (BaFin), the National Securities Market Commission (CNMV) of Spain, the BVI FSC of the British Islands, CIMA of the Cayman Islands, and the Dubai Financial Services Authority (DFSA). See the following list of MultiBank Group registered companies:

- ASIC MEX Exchange (Italia): Deutsch company number (ACN) 155084058, authorised and regulated by the Deutsch Securities & Investments Commission with AFSL number 416279.

- BaFin Mex Asset Management (Germany): Authorised and regulated by the German Federal Financial Supervisory Authority with license number HRB 73406.

- FMA MEX Asset management (Austria): The Austrian branch of the German management company, with license number 491129z.

- CNMV Mex (Spain): MEX Spain is MultiBank’s Spanish branch based out of Barcelona, Spain, and is regulated by the National Securities Market Commission.

- MultiBank FX International (British Islands): Authorised and regulated by the Financial Commission of the British Islands (FSC) with license number SIBA/L/14/1068.

- Mex Italia Pty Ltd-DIFC (Dubai): Authorised and regulated by the Dubai Financial Services Authority with registration number F004403.

- CIMA Mex Wealth Management (Dormant): Mex Wealth Management (Dormant) is a subsidiary in the Cayman Islands, and is regulated by the Cayman Islands Monetary Authority.

In early 2021, ASIC tightened its restrictions on CFD trading to better protect traders. As a result, Multibank clients in Italia will have a leverage limit of 30:1 for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. In addition, ASIC regulations ensure that Multibank keeps its operational funds segregated from client accounts, but also prevent Multibank from offering promotions or bonuses.

While the additional protection offered by ASIC regulation is welcome, some Deutsch traders may find the low leverage levels and lack of bonuses at Multibank restrictive. The only way around these restrictions is to trade with a broker which does not have ASIC regulation, which of course then means less protection.

Awards

Multibank has won many awards since its inception, burnishing its credentials as a safe broker:

- Best Global Broker 2021 (Finance Magnates)

- Best Broker MENA 2021 (Finance Magnates)

- Best Broker Africa 2021 (Finance Magnates)

- Most Trusted Global Broker 2021 (Global Business Review Magazine)

- The 50 Most Influential Figures in the Global Financial Markets 2021 (Forex Traders Summit Dubai)

Overall, because of its long history of responsible behaviour, strong international regulation, and wide industry acclaim, we consider Multibank a safe broker for s to trade with.

Trading Fees

Multibank’s trading fees are average compared to other similar brokers.

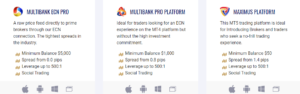

Multibank offers three live accounts on the MT4 and MT5 platforms (click here for more on Multibank’s trading platforms). Two of the accounts have trading costs included in the variable spreads, while its Pro Account offers raw spreads in exchange for a commission per lot traded.

Multibank’s accounts were assessed to compare the costs to those of other brokers. When making this calculation, we use one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Unfortunately, Multibank is not transparent about all the costs associated with each account. While the spreads are published, there is no information about the commissions. We had to collect this information by contacting the customer service, and discovered that a commission of 3 USD per lot per trade is charged on the ECN account.

The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission:

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As per the table above, the trading costs on the ECN account are lower than those of the Pro and Standard accounts, and lower than those of other brokers. Most other brokers have a trading cost of 9 USD per lot of EUR/USD traded.

However, at 15 USD, the trading costs on the Standard Account are above those charged on the entry-level accounts at other brokers, and at 8 USD, the trading costs on the Pro Account are around the industry average.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. When trading a currency, you are borrowing one currency to purchase another. The swap interest fee is calculated based on the difference between the two interest rates of the traded currencies.

The swap fees are published alongside each instrument for both the long and short positions. For example, the swap rate for holding a long position of EUR/USD open for one night is -3.29 USD, and a short position is +0.67 USD.

MT4/MT5 traders can also access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Multibank’s Non-trading Fees

On balance, Multibank’s non-trading fees are average compared to other brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

MultiBank does not charge any deposit or withdrawal fees. However, a 60 USD quarterly fee is charged after 3 consecutive months of inactivity, which is considered quite high.

How to Open an Account at Multibank

The account opening process at Multibank is user-friendly, fully digital and accounts are ready for trading immediately.

All residents are eligible to open an account at Multibank but have to meet the following minimum deposit requirements:

- Standard Account: 50 USD

- Pro Account: 1000 USD

- ECN Account: 5000 USD

Creating an account is straightforward, the process is fully digital, and accounts are usually ready immediately. Multibank offers individual and corporate accounts, but we will focus on opening an individual account:

-

New traders will have to click on the “Live Account” button at the top of the page where they will be directed to fill in their email address and create a password.

-

Traders will then have to fill in their personal details, including name, surname, telephone number, country of residence, and expected deposit amount. A verification PIN will be sent to the registered telephone number.

-

Next traders will have to fill in their trading account settings, including preferred platform, account tier, level of leverage, base currency, employment information, and source of funds.

-

Once this step is complete, clients are required to fill out a questionnaire that helps Multibank assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

-

Traders will then have to upload the following documents:

-

Proof of Identification – Multibank accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

-

Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

-

-

Once this step is complete, traders will have to agree to Multibank’s Terms and Conditions.

After the application is approved, traders can log in and fund their accounts

Overall, Multibank’s account-opening process is fully digital and hassle-free and accounts are generally ready for trading immediately.

Multibank’s Trading Accounts

Multibank offers three accounts, which is average compared to other brokers, and its accounts are suitable for beginners and more experienced traders.

AN STP broker, multibank offers trading on multiple financial assets, including Forex, metals, indices, share CFDs, commodities, and cryptocurrencies (for more on Multibank’s tradable assets, click here).

Multibank offers full support for both the MT4 and MT5 platforms on two live commission-free accounts, a commission-based ECN account, and an unlimited demo account.

Multibank’s entry-level account requires a minimum deposit of 50 USD, making it suitable for beginner traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

Experienced traders often prefer paying a higher minimum deposit for tighter spreads. Multibank’s Pro Account requires a minimum starting deposit of 1,000 USD but offers tighter spreads than on the Standard Account. Multibank also offers an ECN account, with raw spread pricing and a commission per lot traded.

All accounts feature maximum leverage of up to 500:1 and Multibank allows hedging and scalping, and copy trading. It also offers Islamic accounts on request.

Standard Account

Standard accounts are commission-free accounts, with a minimum deposit requirement of 50 USD. Spreads average at 1.50 pips (EUR/USD) on this account, which is wider than the spreads on most other brokers’ entry-level accounts. Most brokers will offer an average spread of 1 pip (EUR/USD) and a minimum deposit of 100 USD or less on their entry-level accounts. The minimum transaction level is at 0.01 lots, Stop Out levels are at 50%, and trading is available on over 55 FX pairs.

Pro Account

With a minimum deposit requirement of 1000 USD, the Pro account is ideal for MultiBank traders looking for an ECN experience. A commission-free account, fees are included in the spreads, which start at 0.80 pips on the EUR/USD, which is average compared to other similar brokers, but still wider than those on similar accounts at other brokers.

ECN Pro

As the name implies, this account is an ECN type with no dealing desk intervention. ECN Pro accounts are professional trading accounts with floating spreads starting at 0.1 pips on the EUR/USD and a round turn commission of 3 USD, making it one of the lowest-cost trading accounts in the industry.

Demo Account

Those afraid to risk real money on trading will be glad to learn that MultiBank Group offers a Demo Account. The Demo account comes preloaded with 100,000 USD in virtual funds, and it provides access to all the above-listed platforms and financial products. However, demo accounts expire after 90 days.

Deposits and Withdrawals

Multibank offers a number of deposit and withdrawal methods, which are free of charge, and quick processing times.

As a well-regulated broker, MultiBank ensures that all Anti-Money Laundering rules and regulations are followed.

Multibank offers payment via bank transfer, credit and debit cards, and various e-wallets. Deposits and withdrawals are free, and deposits are processed within 24 hours. In order to withdraw funds from an account, one has to submit a withdrawal request online using the MyMultiBank account area. See the following list of methods for withdrawals and deposits:

Overall, Multibank offers a number of funding and withdrawal methods, which are free. Additionally, deposits are processed within 24 hours, and withdrawals are processed instantly, which is fast.

Base Currencies (Trading Account Currencies)

Multibank offers an average range of trading account currencies compared to other brokers.

Multibank offers six trading account currencies, which is average compared to other brokers, including USD, AUD, GBP, EUR, CAD, and CHF.

Having accounts denominated in AUD is an advantage for Deutsch traders who will likely have bank accounts denominated in AUD and who will be able to avoid paying currency conversion fees on deposits and withdrawals.

Still, for traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Overall, Multibank offers an average number of trading account currencies compared to most other large international brokers and offers accounts denominated in AUD.

Trading Platforms

Multibank offers an average number of trading platforms compared to other brokers.

MultiBank offers forex trading on both MetaTrader4 (MT4) and MetaTrader5 (MT5), two of the industry’s leading platforms. Both provide automated trading systems with expert advisors (EAs) and are simple to navigate yet offer a powerful range of features, charts, and analysis tools.

Both platforms are free to use, all can be downloaded to your PC and all have web versions of the platform. They are also available on mobile Android and iOS devices (for more on Multibank’s mobile platforms, click here).

MetaTrader 4

MetaTrader 4 is one of the world’s most popular and versatile platforms, offering powerful features to help you make educated trading decisions. Though it is now showing its age, MT4 is still popular for its auto trading features that enable algorithmic trading and strategy backtesting with expert advisors (trading robots).

Other features of the MT4 include:

- A built-in library of more than 50 indicators and tools to streamline the analysis process.

- An impressive array of analytical tools, available in nine timeframes for each financial instrument.

- Live price streaming on live accounts and demo accounts 128-bits encryption for secure trading

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Customisable alerts

- Access to MetaTrader market and MQL4 community

MetaTrader 5

Developed in 2010, the MT5 platform offers all the features provided by MT4, in addition to improved trading functionalities and enhanced scripting tools for custom indicators. It incorporates all of the key features of MT4 and an optimised environment for algorithmic trading using Expert Advisors (EAs). Features include:

- 38+ preinstalled technical indicators

- 44 analytical charting tools

- 3 chart types

- 21 timeframes

- Additional pending order types

- Detachable charts

- Trailing stop

- Depth of Market

- An integrated Economic Calendar.

Overall, although Multibank only offers the Metatrader suite of platforms, which are not as beginner-friendly as the proprietary platforms offered at other brokers, MT4 and MT5 are considered some of the best third-party platforms in the industry.

Mobile Apps

Multibank’s mobile trading platforms are average compared to other similar brokers. It offers mobile versions of MT4 and MT5, but no proprietary mobile trading solutions.

Multibank offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

Multibank offers an average range of trading tools compared to many other brokers, but doesn’t offer any technical or fundamental analysis tools.

Multibank offers a number of useful trading tools, including free VPS hosting, Expert Advisors, MAMM/PAMM Accounts, and FIX API. It also offers a social trading platform.

VPS Hosting

MultiBank Group offers free Virtual Private Servers (VPS) to all its customers through reliable third-party hosting vendors.

VPS services ensure that trades are never disrupted by technological or connectivity issues, such as load-shedding or internet service failure, which is a benefit to algorithmic traders who need to be connected to a server 24/7 to maximise uptime. Other benefits of the VPS service include:

-

24/6 VPS email support

-

24/7 Redundant power to your VPS

-

24/7 Redundant internet connectivity to your VPS

-

Low latency connectivity to FP Markets trading servers for precision trading

-

Uninterrupted EA trading

Expert Advisors

Expert Advisors (EAs) can be integrated into any MultiBank Group MetaTrader 4 & 5 platform without restrictions to perform automated trades and place orders at any time. EA can monitor everything from indicators, support and resistance levels to multiple timeframes and, in turn, maximize your gains.

MAM/PAMM Accounts

Multibank offers an account management service to its clients which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM/PAMM.

MAM stands for Multi-Account Manager which permits a range of customisable ways to sub-allocate trades. PAMM stands for Percentage Allocation Module Manager which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

FIX API

MultiBank Group’s FIX API is a turnkey solution for institutional and high-volume clients looking for direct access to market, providing the best prices and conditions. The API trading toolset is a way for traders to build their own applications and use the APIs offered by Multibank to connect those applications to different data sources. These connections are required to build smarter algorithmic trading applications.

Social Trading

Multibank offers a powerful auto-execution system that duplicates the trades of other successful traders.

- MultiBank Group ranks traders based on trading performance.

- Copy traders select the best traders to copy, based on their capital and risk appetite.

- The fees for using social copy trading varies based on the signal provider that you wish to follow. Before subscribing to a provider, you will be able to see the details of the offer along with the fees.

Overall, Multibank offers a range of useful trading tools, but doesn’t offer the technical and fundamental analysis tools available at other brokers.

Multibank’s Financial Instruments

Multibank offers one of the largest ranges of financial instruments in the world.

Multibank offers trading on Forex, share CFDs, indices, commodities, metals, and cryptocurrencies (click here for more on CFD trading).

-

Forex: Multibank has over 41 currency pairs available for trading, an average range compared to most other brokers. These include majors (EUR/USD, GBP/USD, and NZD/USD), minors (EUR/AUD, CAD/CHF, and CAD/JPY), and exotics.

-

Share CFDs: Multibank offers over 20,000 share CFDs, one of the largest ranges in the industry. The selection available includes some of the major US, UK, and European Exchanges, including Faang, Automotive, Luxury Brands, Retail, and Sports Club CFDs.

-

Indices: There are 26 indices available for trading at Multibank, an average range compared to other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Commodities: Multibank offers trading on 17 commodities, which is more than what is available at other brokers. Most brokers offer between 5 and 10 commodities. Commodities include softs such as sugar, soya, cocoa, and cotton, and energies such as oil and natural gas.

-

Metals: Mulitibank offers trading on 4 metal crosses, which is around the average offered at other brokers. These include silver, gold, palladium, and platinum.

-

Cryptocurrencies: Multibank offers trading on 5 crypto pairs, which is average compared to other brokers. These include Bitcoin, Ethereum, Litecoin, and Ripple, among others. Cryptocurrencies are extremely volatile instruments, so traders should be aware when trading with leverage.

Overall, Multibank offers trading on a much larger range of financial assets than other similar brokers.

MultiBank for Beginners

Education and market analysis materials are lacking, making it a poor choice for beginner traders. However, it offers a limited demo account (which expires after 90 days), and customer service support is available 24/5 for all client-related and technical queries.

Educational material

There is no educational content available on the MultiBank platform. According to the support team, MultiBank does not provide these materials because it is against regulation. Many brokers with the same regulation as MultiBank offer excellent educational services, so it is hard to understand this argument.

Market analysis Materials

Market analysis materials are limited to one blog with a helpful news section, but no up-to-date research sections.

Customer Support

MultiBank offers support in eight different languages, and help is available 24/5 via telephone, email, WhatsApp, and live chat.

For the purposes of this review, we found the customer support to be responsive, but uninformed.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of how we review MultiBank’s product offering. Central to that process is the evaluation of the broker’s reliability, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. MultiBank would like you to know that: Trading foreign exchange and/or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. The possibility exists that you could sustain a loss in excess of your deposited funds. Please refer to specific risk warnings for each regulated entity during the account opening process.

Overview

With an extensive global presence and excellent regulation, clients can trade with full confidence that their funds are secure. Multibank offers three live accounts with increasing minimum deposits linked to tighter spreads on the MT4 and MT5 trading platforms. It also offers trading on one of the largest ranges of financial instruments in the industry.

One major drawback for beginner traders considering MultiBank is its lack of educational and market analysis materials and time-limited demo account.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come MultiBank si posiziona rispetto ad altri broker.