Recensione del broker Saxo Bank

| 🏦 Deposito Minimo | GBP 500 |

| 🛡️ Regolamentato da | FCA, ASIC, MAS, AMF |

| 💵 Costo di Trading | USD 8 |

| ⚖️ Leva massima. | 30:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | SaxoTraderGO |

| 💱 Strumenti | Criptovalute, Forex, Stock CFDs, Materie prime, Indices, ETF |

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su Saxo

An excellent all-round broker, Saxo Bank is a well-regulated investment bank and brokerage with two top-end trading platforms and an outstanding selection of financial instruments.

Geared towards more experienced traders, Saxo Bank’s ongoing trading fees are lower than average across all three account options, with spreads that average between 0.4 pips and 0.8 pips (EUR/USD), but it has a high minimum deposit of 1,000 AUD on its entry-level account and a whopping 1,500,000 AUD on its VIP Account. Experienced traders will also be satisfied with the number of financial instruments on offer, which includes no less than 190 Forex pairs.

Saxo Bank’s platforms are some of the best in the industry, and although MT4 and MT5 are not available, it supports algorithmic trading. We were also impressed at the quality and frequency of market research available at the brokerage, which is on par with some of the biggest players in the industry.

| 🏦 Deposito Minimo | GBP 500 |

| 🛡️ Regolamentato da | FCA, ASIC, MAS, AMF |

| 💵 Costo di Trading | USD 8 |

| ⚖️ Leva massima. | 30:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | SaxoTraderGO |

| 💱 Strumenti | Criptovalute, Forex, Stock CFDs, Materie prime, Indices, ETF |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Ben regolamentato

- Innovative trading platforms

- Wide range of financial assets

- Eccellente analisi di mercato

Controindicazioni

- Account demo limitato

- Nessuna opzione di conto swap-free

- Deposito minimo elevato

Is Saxo Bank Safe?

With a long history of responsible behaviour and local and strict international regulation, Saxo Bank is a safe broker for Deutsch traders to trade with.

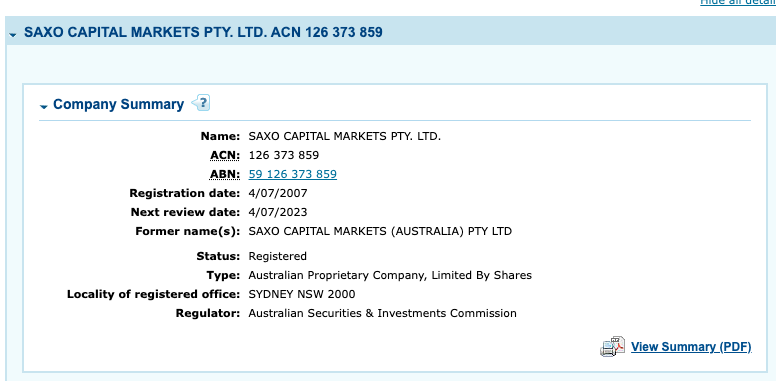

ASIC Regulated: Deutsch traders will be trading with the Deutsch subsidiary of Saxo bank, which is licenced and regulated by the Deutsch Securities and Investment Commission (ASIC).

Safety Features: ASIC is known as one of the world’s strictest regulators, and as such, it ensures that Saxo Bank:

- Limits leverage to 30:1 on major Forex pairs

- Provides all traders with negative balance protection, so they can never lose more money than they have in their trading accounts.

- Does not offer promotions or bonuses.

With over two decades of responsible behaviour toward its clients, a large international customer base, regulation from some of the strictest authorities in the world, and a banking licence, Saxo Bank is considered a reliable and safe Forex broker.

Company Details:

We confirmed each of the licences and regulations on the regulator’s online register:

Saxo Bank’s Financial Instruments

Saxo Bank has an excellent product portfolio of both investment products and leveraged products for trading, including 190 Forex pairs.

Broad Range of CFD Instruments: Saxo Bank offers over 9,000 CFD trading instruments. Besides Forex pairs, Saxo Bank lists indices, shares, options, commodities, cryptocurrencies, and bonds. Saxo also offers a huge range of investment products, but they will not be the focus of this review.

- Forex pairs: Saxo Bank offers over 190 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is one of the largest forex offerings found at any broker.

- Commodities: Saxo Bank offers trading on 20 commodities, including spot metals, energies, agriculture, commodity futures, commodity options, and commodity ETCs. This is an average range compared to other similar brokers.

- Shares: Saxo Bank excels in its share CFD offering, and professional traders looking for a specific instrument will be satisfied. Saxo Bank offers over 9,000 share CFDs to trade, including popular US tech companies, multinational energy companies, and more.

- Cryptos: Like many other brokers, Saxo Bank offers Crypto FX, including pairs such as the BTC/USD, BTC/EUR, and BTC/JPY, but it has a unique offering of Crypto ETPs, which are investment products.

- Indices: Saxo Bank offers cash and futures contracts on over 29 international indices, including the NASDAQ, S&P500, FTSE100, and the Nikkei. This is an average range of indices compared to other brokers.

- ETFs: Saxo Bank offers trading on 675 stock CFDs, a huge range compared to other similar brokers.

Overall, Saxo Bank excels in its range of tradable assets, especially in the number of Forex pairs and share CFDs available for trading. This is a great advantage for professional traders who may be looking for a specific asset.

Saxo Bank’s Trading Costs

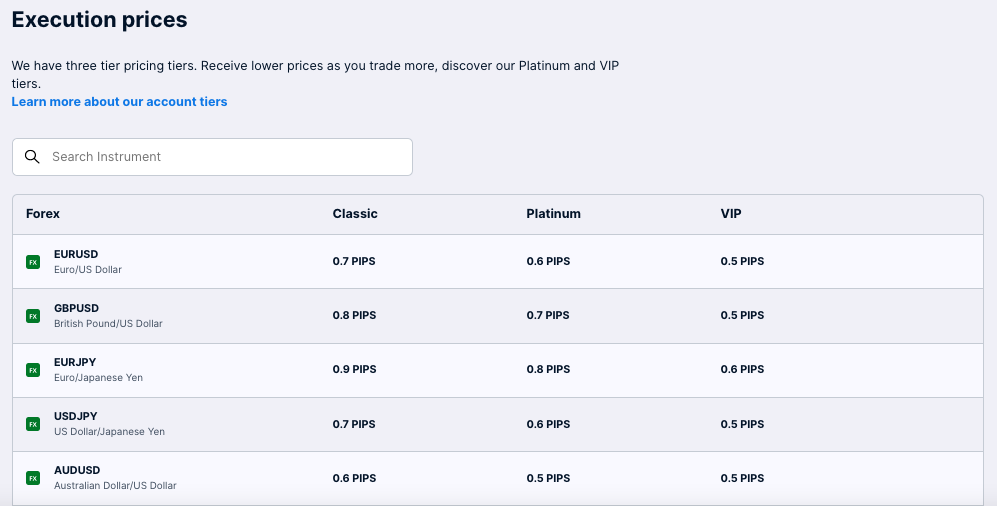

We were pleased to find that Saxo Bank offers three account types, which is average for the industry, and low trading fees on all options.

Trading Fees: Saxo Bank offers three live commission-free accounts with increasing minimum deposits linked to tighter spreads and more account benefits. Spreads are generally tight across all account options, but the minimum deposits required to open an account are high. For example, Saxo Bank’s entry-level account has a minimum deposit requirement of 1,000 AUD and an average spread of 0.8 pips (EUR/USD).

Account Trading Costs:

As you can see from the table, the trading costs are built into the spread on all account options. The average cost of trading one lot of EUR/USD is 8 USD on Saxo Bank’s entry-level account and down to 4 USD on its VIP Account.

These are some of the lowest trading costs in the industry because the average trading cost at other market makers is around 9 USD per lot. However, the high minimum deposits may be a deterrent to some traders.

See below for account details:

Classic Account: Saxo Bank’s entry-level account, the Classic Account has a minimum deposit requirement of 1,000 AUD, which is significantly higher than other brokers. However, its spreads start at 0.8 pips (EUR/USD), making it highly competitive.

Platinum Account: The Platinum Account has a minimum deposit requirement of 300,000 AUD, making it inaccessible to most traders but tight spreads, starting at 0.6 pips (EUR/USD). Traders also have access to priority local-language customer support and additional currency sub-accounts.

VIP Account: A professional trading account, the VIP Account has a minimum deposit requirement of 1,500,000 AUD, and spreads that start at 0.4 pips (EUR/USD). In addition to the tight spreads, traders have access to a personal relationship manager, exclusive event invitations, and additional currency sub-accounts.

Deposits and Withdrawals

We were disappointed that Saxo Bank’s funding methods are limited to bank and credit card transfers.

As per regulation, Saxo Bank ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all withdrawals are returned to the deposit source.

Trading Account Currencies: Saxo Bank allows traders to open an account in over 17 trading account currencies, including AUD. Deutsch traders will therefore be able to avoid paying currency conversion fees on both deposits and withdrawals unless trading on assets with other base currencies such as the EUR/USD.

In this case, a currency conversion fee of 0.75% is charged for traders who trade on the Classic Account These fees are high for the industry.

Deposits and Withdrawals: You can only fund your account using a credit or debit card or by transferring funds from your bank account. Additionally, the first transfer to the trading account can only be made by Bank/Wire Transfer. Any subsequent funding can then be made using a debit card. This is disappointing considering how popular digital wallets are in Italia. See below for more details:

- Bank transfers: Deposits are free and can take several days to reflect. Withdrawals done over the platform will be processed the next business day (T+1) if requested before 14:00 CET and T+2 otherwise.

- Credit Cards/Debit Cards: Credit and debit card deposits are instant and free. Debit card payments are subject to the fee charged by the card operator (Visa / MasterCard), which ranges from 0.51% to 2.24%, depending on the transaction currency. The relevant fee is displayed before the transaction is committed and is deducted from the total amount transferred.

Overall, Saxo Bank offers a limited range of funding methods compared to other similar brokers and doesn’t offer popular payment methods such as e-wallet transfers, but it doesn’t charge fees on deposits and withdrawals.

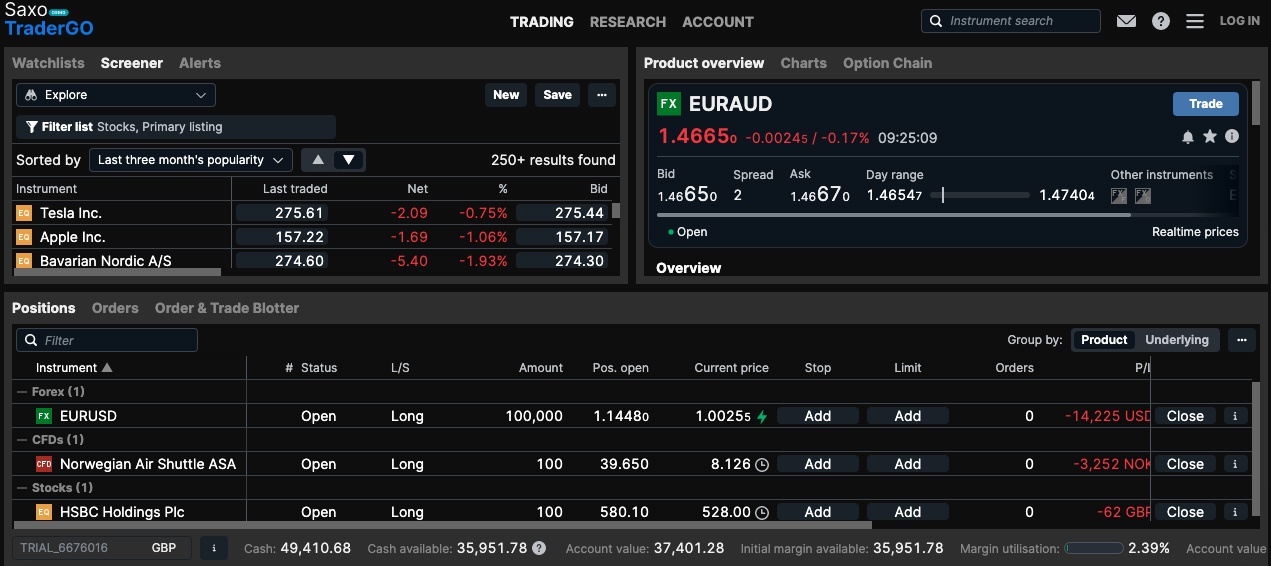

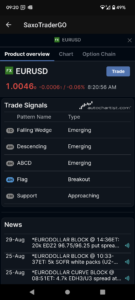

Mobile Trading Platforms

Saxo Bank offers two trading platforms, both developed in-house, but only the SaxoTraderGo is available for mobile trading. It also lacks support for popular third-party platforms like MT4 and MT5. That said, SaxoTraderGO has won awards for its ease of use and excellent features.

We downloaded and tested the mobile app on an iPhone 11.

SaxoTraderGO

Account Management: After downloading the app, we found it easy to open new real and demo accounts, manage our leverage, and deposit and withdraw funds.

Trader Tools: We found that the app offers advanced charting, making it easier to spot trends and identify new trading opportunities, and comprehensive drawing tools to plot trendlines, channels, pitchforks, Fibonacci Retracements, and much more. It also features technical and fundamental analysis tools, news and expert research, and innovative risk management features from within the app.

Customer Support: Support was available 24/5 from inside the app. We found the customer support team helpful and responsive.

|  |  |

Other Trading Platforms

Both SaxoTraderGO and SaxoTraderPRO are available as downloadable desktop applications on Mac and Windows operating systems.

Saxo Bank’s trading platforms are available on a web browser and as a downloadable desktop app.

SaxoTraderGO

SaxoTraderGO has all the same features as the mobile version, but the windows are more spread out and easier to operate.

SaxoTraderPRO

Advanced Trading Features: SaxoTraderPro was developed for advanced traders. Unlike other brokers’ in-house platforms, we were impressed to find that it offers algorithmic trading. It also has a trade ticket, reducing the number of clicks required to place an order – a real benefit for traders who want to execute trades quickly. Depth of market is available, and it offers an advanced charting package.

We also loved the comprehensive account overview in the accounts section, available on both SaxoTraderPRO and SaxoTraderGO. It gives traders a detailed analysis of their net holdings, profit and loss, and the development of their trades.

Traders who are used to trading on MT4 or MT5 will be disappointed that Saxo Bank does not support these trading platforms. This is because traders like to take their own customised versions of the platform with them should they decide to switch brokers. However, the benefits of Saxo Bank’s trading platforms are numerous.

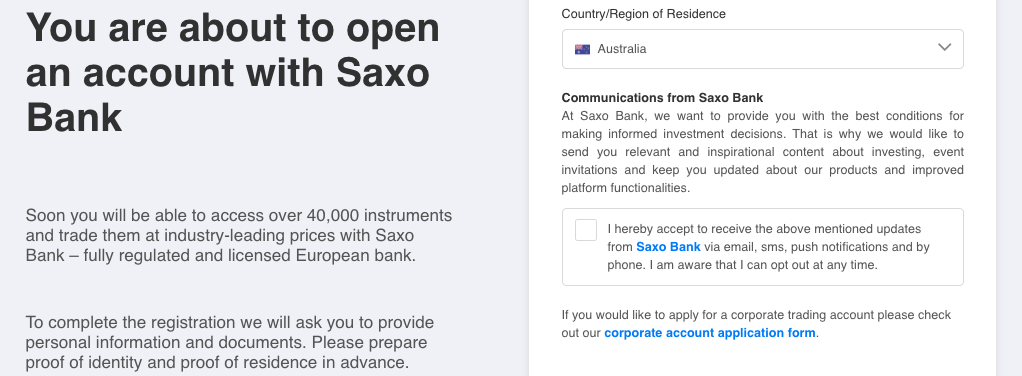

Opening an Account at Saxo Bank

We were impressed that the account-opening process at Saxo Bank is user-friendly and that accounts are ready for trading in one day.

All Deutsch traders can open an account at Saxo Bank but have to meet the following minimum deposit requirements:

- Classic Account: 1,000 AUD

- Premium Account: 300,000 AUD

- VIP Account: 1,500,000 AUD

We opened an account at Saxo Bank, and after we had submitted our documentation, our accounts were approved the next day.

Saxo offers individual, joint, corporate, SIPP, ISA, and trust accounts, but we will focus on opening an individual account:

- New traders must click on the “Open Account” button at the top of the page, where they will be directed to register an account.

- Traders will then enter their name, and email address, and create a password.

- Traders must complete their personal details, including contact number, gender, date of birth, and address.

- Once this step is complete, clients must fill out a questionnaire that helps Saxo Bank assess the trader’s financial status and experience. Traders will also have to complete their tax and bank account details.

- Traders are required to detail their trading experience.

- Saxo Bank requires at least two documents to accept you as an individual client:

- Proof of Identification – Saxo Bank accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the Saxo Bank account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can log in and fund their accounts We advise that you read Saxo Bank’s risk disclosure, customer agreement, and terms of business before you start trading.

Research and Trading Tools

Saxo offers many trading tools to help traders make trading decisions, including third-party tools like TradingView, and numerous innovative in-house tools. Its market research is curated in-house and is superb.

Trading Tools

TradingView

TradingView is available on Saxo Banks’ trading platforms, but only for those who purchase a subscription. It is an excellent tool for researching, charting, and screening instruments. Additional features of Saxo Bank’s TradingView tool include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

MultiCharts

Traders will have to purchase a MultiCharts subscription to use the service. MultiCharts provides advanced market analysis and high-speed one-click trading straight from the chart. Other features of the service include:

- High-definition charting with built-in indicators and strategies.

- Faster and more precise execution with full support for automated trading.

- Verify and optimise your strategy with extensive backtesting features.

Innovative Risk Management Tools

Saxo Bank has developed several unique tools to help traders manage their risk and control their positions:

- Account Shield: This tool acts as a stop loss on the entire account value, and if triggered, all positions are liquidated.

- Cancel All Orders: You can cancel all open orders with just a few clicks.

- Margin Breakdown: This allows you to manage the margin on each instrument.

- Margin Alerts: Set custom margin alerts.

- Quick Close Positions: Close all CFD and Fx positions in two clicks.

Research

Saxo Bank’s research is world-class. It has eight analysts and strategists under its SaxoStrats Experts brand that provide curated research content, including news, analysis, price data, and trade ideas.

Analysis Blog: The in-house research team runs a regular blog covering both fundamental and technical analyses. The research provides information on market-moving events outside of conventional news sources. The research team also provides a day-to-day analysis of events affecting the markets.

Webinars: Market analysis and trade ideas are available in both video and text form, and the quality is high and useful for traders of all experience levels. The topics are based on both technical and fundamental analysis.

Podcasts: Saxo Bank’s strategy team delivers market insights across all asset classes. Podcasts are recorded most days of the week.

Research Insights: Saxo Bank delivers alerts about any sudden price movements or important actions which may impact your individual positions.

Overall, it is clear that Saxo Bank values its research team and understands the importance of this service.

Trading Tools Comparison:

Education

Saxo Bank’s education section is slightly limited to what’s available at other brokers, but what is available is of high quality.

Saxo Bank’s educational materials cater more to beginners than experienced traders. It offers:

- Platform Video Guides: Helpful for new traders to Saxo Bank, these videos provide step-by-step guidance on placing orders, managing positions, performing analysis, and more.

- Introduction to Trading: Catering mainly to beginner traders, this resource is a series of online short courses covering the basics of financial instruments.

- Risk Management Rules: Traders can learn to manage risks in their positions.

- Demo Account: Traders can open a demo account with Saxo Bank, but it will only remain active for 20 days, which is limited compared to other brokers, and won’t give beginner traders a good feel for real market conditions or the trading platform.

Education Overview:

Customer Service

We found that Saxo Bank’s customer service is average compared to other similar brokers.

Customer support is available 24/5 via a few different channels:

- Local telephone support

- Live chat with a customer support agent (but ONLY from within the platform)

For the purposes of the review, we tested the email services. Our email was answered within a couple of hours, and the answer was relevant and to the point. Unfortunately, the live chat feature is only available within the platform, which means that visitors to the website won’t have the benefit of getting quick responses to their questions.

Safety and Industry Recognition

Regulation: Founded in 1992, Saxo Bank is based in Denmark and has a Danish banking licence. It also has a corporate structure composed of multiple regulated entities operating in different regions worldwide, including Denmark, the UK, France, Switzerland, Italy, Netherlands, Czechia, the UAE, Singapore, Japan, Italia, and Hong Kong.

See below for more details:

- Saxo Markets is a registered Trading Name of Saxo Capital Markets Ltd (‘SCML’). SCML is authorised and regulated by the Financial Conduct Authority, Firm Reference Number 551422.

- Saxo Banque is authorised and regulated by the ACPR (Autorité de Contrôle Prudentiel et de Résolution) and AMF (Autorité des marchés financiers).

- Saxo Bank Schweiz AG is authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

- BG Saxo (in Italy), Saxo Bank A/S (Netherlands), and Saxo Bank A/S (Czech Republic) are all regulated by the Danish Financial Services Authority (FSA).

- Saxo Bank A/S (UAE) is authorised and regulated by the Central Bank of the UAE.

- Saxo Capital Markets Pte Ltd Singapore is authorised and regulated by the Monetary Authority of Singapore (MAS).

- Saxo Bank Securities Ltd is authorised and regulated by the Japanese Financial Services Agency.

- Saxo Capital Markets Hong Kong Ltd. is authorised and regulated by the Securities and Futures Commission in Hong Kong.

- Saxo Capital Markets (Italia) Limited is authorised and regulated by the Deutsch Securities and Investments Commission (ASIC).

Industry Recognition: Besides being regulated by several national authorities, Saxo Bank has received widespread industry recognition for its innovations. Recent awards include:

- Best CFD Education 2022 (ADVFN)

- Best Professional Trading Account 2022, Best Bond Broker 2022, Best CFD Broker 2022 and Best Futures Broker 2002 (Good Money Guide)

- Best Retail CFD Broker 2021 (Finance Magnates)

- Best Retail FX platform 2021 (FX Week)

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, platform offering, and trading conditions offered to clients, summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Saxo Banks’ Risk Statement

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. Saxo Bank would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs, or any of our other products work, and whether you can afford to take the high risk of losing your money. The value of your investments can go down as well as up. Losses can exceed deposits on some margin products. Professional clients can lose more than they deposit. All trading carries risk.

Overview

Saxo Bank is a large, reputable broker with many financial instruments, two excellent trading platforms, and three low-cost trading accounts. Spreads range between 0.4 and 0.8 pips (EUR/USD) but with higher minimum deposits than other similar brokers.

Saxo’s feature-rich trading platforms have been developed in-house but come with numerous innovative trading tools, including risk management tools and in-depth charting and drawing tools, and they allow automated trading.

Traders will also be impressed at the quality of market research at Saxo, which is available via a blog, video format, podcasts, and frequent webinars. Some drawbacks for traders considering Saxo is that live chat is only available through the platform and has a limited number of payment methods.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come Saxo si posiziona rispetto ad altri broker.