Recensione del broker Fortrade

| 🏦 Deposito Minimo | USD 100 |

| 🛡️ Regolamentato da | FCA, ASIC, IIROC |

| 💵 Costo di Trading | USD 20 |

| ⚖️ Leva massima. | 100:1 |

| 💹 Copy Trading | No |

| 🖥️ Piattaforme | MT4 |

| 💱 Strumenti | Obbligazioni, Materie prime, Criptovalute, Energie, Stock CFDs, ETF, Forex, Indices, Metalli |

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su Fortrade

Fortrade may appeal to traders who prefer a simple account structure and a wide variety of CFDs to trade. However, traders should be aware that Fortrade’s trading costs are significantly higher than other similar brokers. Its single commission-free account has a low minimum deposit requirement of 100 AUD, but extremely wide spreads that average at 2.00 pips on the EUR/USD.

Fortrade offers a diverse range of trading assets, including specialty CFDs such as bonds and stock DMAs that are rarely found at other brokers. Its trading platforms include MT4 and a user-friendly proprietary platform, optimised for both desktop and mobile trading.

Fortade’s education and analysis section is comprehensive and will be useful for beginner and advanced traders alike, with frequent in-house market analysis of the European and US sessions.

| 🏦 Deposito Minimo | USD 100 |

| 🛡️ Regolamentato da | FCA, ASIC, IIROC |

| 💵 Costo di Trading | USD 20 |

| ⚖️ Leva massima. | 100:1 |

| 💹 Copy Trading | No |

| 🖥️ Piattaforme | MT4 |

| 💱 Strumenti | Obbligazioni, Materie prime, Criptovalute, Energie, Stock CFDs, ETF, Forex, Indices, Metalli |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Buono per i principianti

- Ottima scelta di piattaforma

- Ben regolamentato

- Ampia gamma di asset

Controindicazioni

- Ampi spread

Is ForTrade Safe?

Yes, Fortrade is a safe broker for to trade with. It maintains regulation from the FCA in the UK, ASIC in Italia, CySEC in Cyprus, IIROC of Canada, and the NBRB of Belarus.

Fortrade is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Deutsch Securities and investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Investment Industry Regulatory Organization of Canada (IIROC) and was included by the National Bank of the Republic of Belarus (NBRB) on the Register of Forex companies in 2018. A well-regulated broker, Fortrade will not manipulate market prices. See the following list of Fortrade Group registered companies:

- Fortrade Ltd. is regulated by the FCA under registration number FRN:609970

- Fort Securities Italia PTY LTD (T/A Fortrade Italia) is licensed and regulated by the ASIC under registration number AFSL number: 493520.

- Fortrade Cyprus Ltd is regulated by the Securities and Exchange Commission (CySEC) under company registration number 392231.

- Fortrade Canada Limited is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) under BC1148613.

- Fort Securities Belarus is authorized and regulated in Belarus by the NBRB, FRN: 193075810.

In early 2021, ASIC tightened its restrictions on CFD trading to better protect traders. As a result, Fortrade clients in Italia will have a leverage limit of 100:1 for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. In addition, ASIC regulations ensure that Fortrade keeps its operational funds segregated from client accounts, but also prevent Fortrade from offering promotions or bonuses.

While the additional protection offered by ASIC regulation is welcome, some traders may find the low leverage levels and lack of bonuses at Fortrade restrictive. The only way around these restrictions is to trade with a broker which does not have ASIC regulation, which of course then means less protection.

Overall, because of its strong international regulation, long history of responsible behaviour, leverage restrictions, and provision of negative balance protection, we consider Fortrade a safe broker to trade with.

Fortrade’s Trading Fees

Fortrade’s trading fees are higher than other similar brokers.

Unlike other brokers that offer a range of accounts with higher minimum deposits linked to tighter spreads, Fortrade offers one live commission-free account on two different platforms – MT4 and its proprietary Fortrade platform (click here for more on Fortrade’s platforms).

Fortrade has a simple account structure with trading costs that are significantly higher than the industry average. Fortrade states that its revenue is derived from the spread, but it is not transparent about how the spreads are derived.

Fortrade’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table, the trading costs are built into the spread, which is variable and gets wider or tighter depending on trade volume and market volatility.

The average cost of trading one lot of EUR/USD is 15 USD, which is significantly higher than other similar market maker brokers. Most other good market maker brokers have an average trading cost of 9 USD per lot of EUR/USD traded.

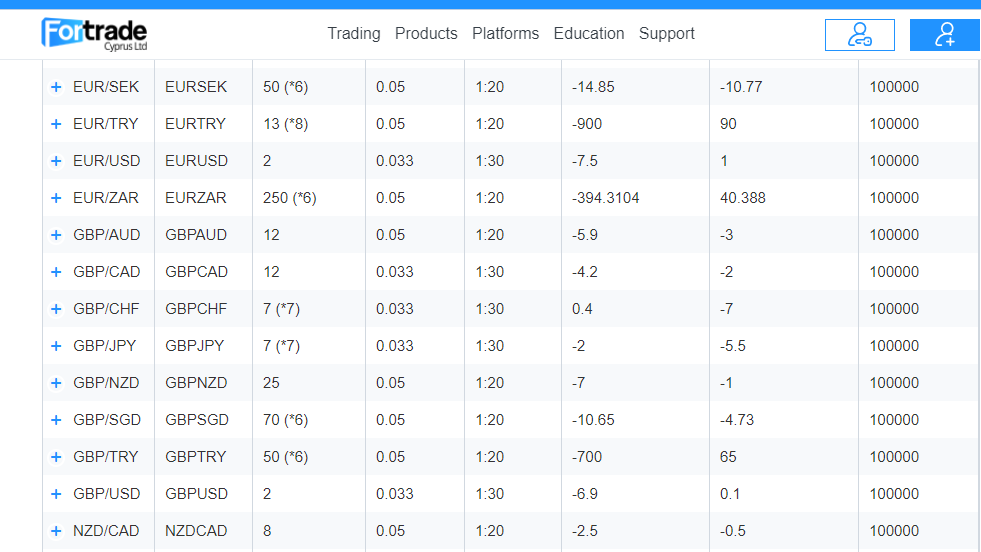

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. When trading a currency, you are borrowing one currency to purchase another. The swap interest fee is calculated based on the difference between the two interest rates of the traded currencies.

Fortrade provides a Swap Rates Calculator for traders to calculate these costs. For example, the swap rate for holding a long position of EUR/USD open for one night is -7.5 USD, and a short position is -1 USD.

Overall, Fortrade offers only one live commission-free account with high trading costs.

Fortrade’s Non-trading Fees

Fortrade’s non-trading fees are average compared to other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Fortrade charges inactivity fees, withdrawal, and deposit fees. For example, a fee of up to 40 USD/EUR/GBP is charged for deposits and withdrawals via bank wire transfer (click here for more on deposits and withdrawals).

An inactivity fee of 10 USD (or currency equivalent) will be charged per month on accounts that have been dormant for more than 180 days. Fortrade will deduct the inactive account fee from the client account balance on the day following the expiry period and then every 30 days thereafter. Once the account balance totals zero, the account will be closed.

Overall, these fees are around the average charged by other similar brokers.

How to open an Account at Fortrade

The account opening process at Fortrade is user-friendly, fully digital and accounts are ready for trading immediately.

All residents are eligible to open an account at Fortrade but have to meet the minimum deposit requirement of 100 AUD, although Fortrade recommends a minimum starting deposit of 500 AUD.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready immediately. Fortrade offers individual, joint, and corporate accounts, but we will focus on opening an individual account:

-

New traders will have to click on the “Sign Up” button at the top of the page where they will be directed to fill in their personal details, including name, surname, telephone number, and email address.

-

Next, traders will have to fill in their country of residence, preferred trading account currency (USD, EUR, GBP, and AUD) identity number, date of birth, physical address, and choose a password.

-

Once this step is complete, traders will complete a form detailing their financial status, including employment status, the reason for trading, annual income, source of funds, and check that they have read and understood the Terms and Conditions, Order Execution Policy, and OTC Transactions Agreement.

- clients are then required to fill out a questionnaire that helps Fortrade assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

-

Traders will then be able to deposit funds.

-

In order to complete the registration process, Fortrade requires at least two documents:

-

Proof of Identification – Fortrade accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

-

Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

-

After the application is approved, traders can log in and fund their accounts

Overall, Fortrade’s account-opening process is fully digital and hassle-free and accounts are generally ready for trading immediately.

Fortrade’s Trading Accounts

Fortrade offers one live account, which is limited compared to other brokers, and its account is suitable for beginner traders.

A market maker, Fortrade offers trading on multiple assets, including Forex, energies, cryptocurrencies, indices, commodities, metals, and share CFDs. Fortrade offers a single live commission-free account for Forex and CFD trading.

With a minimum starting deposit of 100 AUD, Fortrade’s account is suitable for beginner traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

However, experienced traders generally prefer paying higher minimum deposits and a commission per trade in exchange for tighter spreads, which is not available at Fortrade.

Because of the ASIC regulation, traders can access leverage of up to 100:1 on forex currency pairs, which is lower than the leverage offered by other brokers.

Fortrade allows all trading strategies, including hedging, scalping, and copy trading. It also offers Islamic swap-free accounts. See below for account details:

Standard Account

In order to open an account, traders must deposit at least 100 AUD. Spreads average at 2.00 pips (EUR/USD), which is significantly wider than the spreads at other brokers, but no commissions are charged.

Demo Accounts

Traders that sign up for a demo account receive a virtual currency balance of 10,000 AUD. Fortrade’s demo accounts never expire and allow traders to trade risk-free on all of its available platforms.

Overall, Fortrade offers one live account on the MT4 and Fortrade platforms, which is suitable for beginner traders, but with higher than average trading costs.

Deposits and withdrawals

Fortrade offers a variety of deposit and withdrawal methods, and while withdrawals are free, some deposit methods incur a fee.

Due to Anti-Money Laundering regulations, ForTrade only remits funds back to the source – the amount that was deposited using said bank card can only be withdrawn to that same card, and only for the amount deposited. Likewise, if funds were deposited via wire transfer, funds must be withdrawn back to the same bank account. The following methods can be used for deposits and withdrawals:

- Visa/Mastercard: Email Fortrade a copy of your deposit receipt to fund and activate your trading account. Withdrawals may take up to fifteen (15) business days (not as quick as other brokers). In some cases, withdrawals of funds deposited by credit or debit card are limited by the card issuer, and cannot exceed the original amount deposited.

- Bank Wire Transfer: Deposits are free, and estimated transaction time is five (5) business days. Withdrawals may take up to seven (7) business days to reach your account. Most International Wire Transfers and TTs are approximately 40 USD.

- Neteller: Deposits need to be approved by emailing a copy of the deposit receipt to the broker. Withdrawals can take 2 – 6 hours to be processed.

- Skrill: Email Fortrade a copy of your deposit receipt to fund and activate your trading account. Withdrawal requests must be made via email with the Skrill Account ID.

See below for more details on deposits and withdrawals:

Withdrawals can be made from within the client area by filling out the online withdrawal form. Requests are processed within 2 days of being submitted.

Please note that if you request a withdrawal with a value higher than your Free Margin, you will be notified of the maximum amount you can withdraw based on your current Free Margin calculation. Free Margin is the amount calculated from the value of the equity of the account less the used margin of open positions. This is a dynamic calculation that changes with the changing values of the open positions.

Base Currencies

Fortrade offers a limited number of base (trading account) currencies compared to other similar brokers.

Trading accounts can only be denominated in four base currencies – EUR, USD, GBP, and AUD, which is limited compared to other brokers. Most other brokers denominated accounts in at least five to ten currencies. Having accounts denominated in AUD is a benefit to Deutsch traders who will likely have accounts denominated in AUD, and who will be able to avoid paying currency conversion fees on deposits and withdrawals.

Still, for traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Overall, Fortrade offers fewer trading account currencies than most other large international brokers, but it offers accounts denominated in AUD.

Trading Platforms

Fortrade’s platform support is average compared to other similar brokers.

ForTrade offers traders the industry-standard MT4 platform in addition to its own proprietary ForTrade platforms which are optimized for desktop or mobile use. These allow immediate and accurate access to international financial markets and deliver feature-rich, user-friendly interfaces designed to fulfill all trading needs and boost trading performance. Customer service is available 24/5 to answer questions about the software and help with setting it up.

MetaTrader 4

Whether you are a novice or a seasoned trader, the MetaTrader 4 (MT4) platform is an award-winning favourite. The platform hosts a selection of features that provide a powerful trading experience to suit a variety of strategies.

Users benefit from 30 built-in technical indicators and 24 graphical objects, plus nine timeframes and three charting types. Automated trading is available through Expert Advisors (EAs) along with multiple order types and one-click trading. MT4 also provides access to full trading histories.

Web Fortrader

Fortrade offers its own proprietary platform – Fortrader Webtrader, accessible from any PC with an internet connection. The platform delivers real-time data with high speed and precision. The One-Stop-Shop function allows traders to track, analyse, and trade using a cross-device platform, saving time and hassle.

Fortrade’s Mobile Trading Platforms

Fortrade’s mobile trading support is average compared to other brokers.

Fortrade offers both MT4 and the Fortrader platform on both Android and iOS.

Mobile Fortrader

Mobile Fortrader allows you to stay connected and manage your account from anywhere, any time. Easily turn your Android or iOS device into a virtual trading desk. It affords you to make smart and successful trading decisions from the palm of your hand.

MT4 Mobile

MT4 is also available on both Android and iOS, but traders should be aware that there is some loss in functionality when compared to the desktop trading platform, including reduced time frames and fewer charting options. However, traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Fortrade’s Trading Tools

Fortrade’s trading tools are limited compared to other brokers.

Fortrade’s trading tools are limited to Trading Central and a number of trading calculators.

Trading Central

Trading Central is available to clients who register a live account. A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to curate relevant information. This tool essentially supports traders without the technical know-how in making trading decisions. Trading Central is one of the most popular trading tools available and provides excellent market analysis, and Fortrade does well to offer this service to its clients.

Trading Calculators

Fortrade offers four trading calculators:

- Currency Converter Tool: Fortrade’s currency converter tool uses real-time market rates as presented in the Fortrader trading platforms and applications.

- Margin Percentage Calculator: With Fortrade’s Margin Calculator, traders can calculate exactly how much margin is required in order to guarantee a position that they would like to open and adjust its size accordingly.

- Swap Rates Calculator: The Swap Rate Calculator helps traders calculate the fee they will be charged based on the instrument they are trading, the account currency, and trade size.

- Pip Value Calculator: The PIP Calculator allows traders to find out the exact value of their trading positions in the currency of their trading account.

Overall, Fortrade’s trading tools are limited compared to other brokers, and it would do well to add some more tools to its trading arsenal to help clients make better trading decisions.

Fortrade’s Trading Instruments

Fortrade offers trading on a broader range of financial asset classes than other similar brokers.

Fortrade offers trading on a broad range of tradable assets, including Forex pairs, commodities, energies, metals, indices, stock CFDs, stock DMAs, bonds, and cryptocurrencies.

-

Forex: Fortrade has over 50 currency pairs available for trading, an average number compared to most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

-

Stock CFDs: Fortrade offers 277 stock CFDs, which is average compared to other large international brokers. the selection includes some of the most influential companies listed on NYSE, NASDAQ, and other European stock exchanges.

-

Indices: There are 18 indices available for trading at Fortrade, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Commodities: Fortrade offers trading on 23 commodities, a much broader range than other brokers. Most brokers offer between 5 and 10 commodities. Commodities include softs such as sugar, cocoa, and cotton, metals such as silver and gold, and energies such as oil.

-

Energies: Like other brokers, Fortrade offers trading on five energies, including oil, Brent Crude, gasoline, heating gas, and natural gas.

-

Metals: Fortrade offers trading on 10 precious metals, including gold, silver, palladium, and platinum. This is a much broader range than other brokers.

-

-

Stock DMAs: In addition to its range of share CFDs, Fortrade also offers 2 DMA stocks – allowing traders to trade directly on stock exchanges around the world. These include the Colgate-Palmolive company, Garmin, and Nike, among others.

-

Bonds: Fortrade offers CFD trading on the three most popular Bonds in the world – UK Gilts, Euro Bunds, and the US 10-year.

-

Cryptocurrencies: Cryptocurrency CFDs are available on some of the Fortrade accounts. At the time of writing, there are 6 USD currency pairs available, including Bitcoin and Ethereum. It is not unusual for spreads to be as wide as 75 pips on Bitcoin, but cryptocurrency spreads vary greatly, so if you trade these currencies, watch your margins

Overall, Fortrade offers a broad range of assets classes for CFD trading, including some specialty CFDs that are rarely seen at other brokers, such as stock DMAs and bonds.

ForTrade for Beginners

ForTrade is a good broker for beginners and has an excellent repository of educational material, up-to-date market analysis, online trading seminars, and trading courses. Its demo accounts do not expire and allow one to practice trading risk-free with virtual money. The responsive international customer service team is also available 24-hours a day, 5 days a week for all client account and technical questions.

Educational Material

Fortrade’s educational materials are comprehensive and in-depth and provide a good overview of online trading.

Fortrade’s Academy comprises online seminars/webinars, eBooks, training courses, tutorial videos, trading strategies, and more. Traders do not need to register an account to access this material.

Forex & CFD eBooks: Fortrade offers four free downloadable ebooks. Topics include CFDs and Stocks, Commodities and Futures, Advanced eBook, and the Forex eBook.

Courses: Fortrade’s core educational courses are divided into beginner and advanced trading courses. The content is presented in downloadable PDF and video formats and includes a variety of topics.

Videos: Fortrade offers 6 trading videos to help traders find their footing. Topics include Advanced Technical Analysis, Basic Technical Analysis, Market Analysis, Trading Psychology, Capital Management, and The World of Global Trading. The tutorial videos delve into the basics of using the platforms, order types, trading strategies, chart trading, and more on technical analysis.

Trading Webinars/Online Seminars: Fortrade’s trading webinars are run by its team of in-house analysts who cover real-time market analysis, Forex strategies, and recent market events. Webinars are run every Wednesday, and archives of previous webinars can be found on the website.

Analysis Material

Fortrade’s market analysis materials are frequently updated, in-depth, and relevant.

ForTrade’s research and analysis section provides an up-to-date morning and evening market preview, a weekly analysis, and a microanalysis. Daily stories are related to future market movements. All materials are curated by its team of in-house analysts. Other sections include an economic calendar for planning and historical overviews which assist clients in identifying trading opportunities.

Customer Support

The responsive customer support team at ForTrade is available 24/5 via telephone, live chat, and email.

Live chat support is particularly good with short wait times and staff that are able to help with a range of queries, from withdrawal problems and apps not working to how to close or delete an account. Alternatively, Fortrade provides an FAQ section for self-service assistance.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ForTrade Group offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

ForTrade’s Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Fortrade would like you to know that: When performing transactions in the OTC Forex market, the possibility of making a profit is inextricably linked with the risk of losses. Conducting transactions can lead to the loss of part or all of the initial investment. Before commencing operations, they urge you to make sure you understand the risks involved and have sufficient skills to invest.

Overview

ForTrade is a serious market maker broker that is well-regulated by multiple top-tier authorities. ForTrade only offers one live commission-free account with wider spreads than many of its competitors on two platforms – MT4 and its own proprietary ForTrader platform. Trading is offered on a broader range of tradable instruments than many other brokers, including specialty CFDs such as stock DMAs and bonds. Additionally, its educational and market analysis materials are excellent and its customer support is responsive and helpful, a real benefit for beginners with many questions.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come Fortrade si posiziona rispetto ad altri broker.