Recensione del broker Fondex

| 🏦 Deposito Minimo | USD 1 |

| 🛡️ Regolamentato da | CySEC, Fi, BaFin, FSA-Seychelles |

| 💵 Costo di Trading | USD 7.80 |

| ⚖️ Leva massima. | 500:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | cTrader |

| 💱 Strumenti | Criptovalute, Energie, Stock CFDs, ETF, Forex, Indices, Metalli |

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su Fondex

Established in 2011, Fondex provides an optimal trading environment for traders looking for a wide range of tradeable assets and low trading costs on the cTrader platform.

An unusual broker, Fondex only offers support for the cTrader platform, which may be an instant turn-off for many traders, especially those who have a long history with Metatrader, but it offers some of the best trading conditions in the industry. Fondex’s single live commission-free account has no minimum deposit requirements and spreads that average at 0.28 pips on the EUR/USD, a lower trading cost than most other brokers. cTrader is a powerful and feature-rich alternative to MetaTrader’s platforms, with a built-in copy trading function and advanced automation tools.

Trading is offered on multiple assets, including 80 FX pairs, over 900 equities, 11 cryptocurrency pairs, and a wide range of indices, metals, energies, and ETFs. Fondex’s educational and market analysis materials are comprehensive and in-depth, but unstructured, making it difficult to find what you are looking for.

| 🏦 Deposito Minimo | USD 1 |

| 🛡️ Regolamentato da | CySEC, Fi, BaFin, FSA-Seychelles |

| 💵 Costo di Trading | USD 7.80 |

| ⚖️ Leva massima. | 500:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | cTrader |

| 💱 Strumenti | Criptovalute, Energie, Stock CFDs, ETF, Forex, Indices, Metalli |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Ben regolamentato

- Deposito minimo basso

- Account di Copy Trading

- Strumenti di trading innovativi

Controindicazioni

- Account demo limitato

- Opzioni di account limitate

Is Fondex Safe?

Yes, Fondex is a safe broker for traders to trade with. It maintains regulation from CySEC in Cyprus and the FSA of Seychelles.

Founded in 2011 in Cyprus, Fondex is the trade name of TopFX Ltd. In Europe, TopFX Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence number 138/11. Outside of Europe, Fondex Ltd is licensed by the Seychelles Financial Services Authority (FSA) with a Securities Dealer License No: SD037.

Fondex is also registered with 17 EU Regulators, including the Federal Financial Supervisory Authority (BaFin) and the Financial Conduct Authority (FCA). To maintain licensing and registrations, Fondex is required to fulfil capital adequacy requirements, submit financial reports to the regulators, and undertake a detailed annual audit performed by an independent auditor.

s will be trading under the Fondex Ltd subsidiary regulated by the Seychelles FSA. The FSA’s rules are not as strict as those of CySEC, but it does allow Fondex to provide its clients with higher leverage.In accordance with FSA regulation, Fondex holds all client funds in segregated accounts and provides negative balance protection, which means that clients can never lose more than is in their trading accounts.

Awards

Fondex has also received widespread recognition from the Forex industry, most recently winning the Award for Best cTrader Broker Cyprus 2020 (International Business Magazine Awards) and Best cTrader Broker Award 2020 (AtoZ Markets). Previous awards include Best Trade Execution 2018 and Best Cryptocurrency Broker 2018 (World Finance Awards).

Overall, with a long history of responsible behaviour, strong international regulation, negative balance protection, and wide industry recognition, we consider Fondex a safe and secure broker for s to trade with.

Fondex Trading Fees

Fondex’s trading fees are lower than other similar brokers.

There is no account choice at Fondex, which is unusual as most of its serious competitors have several account types with tighter spreads linked to higher deposit requirements. Click here for more details on Fondex’s single account.

Fondex’s account was assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission. In a welcome display of transparency, Fondex publishes all its spread data for each instrument in easy-to-read charts showing fluctuations in the spread over time.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table, the trading costs are built into the spread, which is variable and gets wider or tighter depending on trade volume and market volatility.

The average cost of trading one lot of EUR/USD is 5 USD, which is much tighter than the spreads at other similar brokers – most other brokers have a trading cost of 9 USD per lot of EUR/USD. Additionally, Fondex has no minimum deposit requirements, making it accessible to all traders.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. In currency trading, the swap rate is determined by the direction of your trade (short or long) and the overnight interest rate differential between the two currencies. In Share or Index CFDs trading, holding costs are based on other factors such as the interbank interest rate for the currency of the relevant asset.

Unfortunately, Fondex does not publish any of the swap fees associated with each instrument on its website. These can be found in the market watch window of the cTrader platform.

Overall, Fondex’s trading fees are lower than other brokers and there are no minimum deposit requirements to open an account.

Non-trading Fees

Fondex’s non-trading fees are lower than other brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Fondex does not charge fees for deposits or withdrawals, but it charges an inactivity fee of 5 USD/GBP/EUR/CHF per month after 90 days of inactivity, which is reasonable.

Overall, these non-trading fees are some of the lowest in the industry.

Opening an Account at Fondex

The account opening process at Fondex is user-friendly, fully digital and accounts are ready for trading immediately.

All residents are eligible to open an account at Fondex and there are no minimum deposit requirements.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready immediately. Fondex offers individual and corporate accounts, but we will focus on opening an individual account:

-

New traders will have to click on the “Start Trading Now” button at the top of the page where they will be directed to fill in their email address and register a password.

-

Traders will then have to fill in their personal details, including name, surname, and date of birth, and physical address.

- Once this step is complete, clients are required to fill out a questionnaire that helps Fondex assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection. Traders who fail the appropriateness test will be encouraged to open a demo account before proceeding with live trading.

-

Traders will then have to upload the following documents:

-

Proof of Identification – Fondex accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

-

Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

-

-

Once this step is complete, traders can fund their accounts and begin trading.

Overall, Fondex’s account-opening process is fully digital and hassle-free and accounts are generally ready for trading immediately.

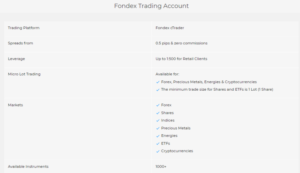

Fondex’s Trading Account

Fondex offers only one account type, whereas most brokers will provide at least two or three, but its account is suited to both beginners and more experienced traders.

With a single registration, Fondex clients can open both a real and a demo account, and unusually, trading is only offered on the cTrader platform.

Fondex’s account is suited to both beginners and more experienced traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek. Fondex’s trading account has no minimum deposit requirement, putting it within the reach of beginner traders.

While experienced traders often prefer higher minimum deposits and tighter spreads, in exchange for a commission per lot, Fondex offers a low-cost trading environment, making it appealing to more experienced traders.

Fondex works with liquidity providers to provide traders with the best prices and fastest execution possible. While it is not a true ECN broker, Fondex provides traders with market pricing sourced from Tier 1 banks, prime brokers, and hedge funds.

Fondex offers trading on over 1000 instruments, including over 80 FX pairs and 11 cryptocurrencies, alongside a wide range of indices, equities, metals, energies, and ETFs. Fondex allows hedging, scalping, and copy trading and offers swap-free options to clients of the Muslim faith. The maximum leverage is up to 500:1 for retail clients under the FSA regulation. See below for account details:

Live Account

Fondex offers a single commission-free account type on the Fondex cTrader platform. Maximum leverage is 500:1, and there is no minimum deposit requirement. Fondex provides raw spreads from its liquidity providers, but a small spread mark-up is charged, with spreads that average at 0.28 pips on the EUR/USD.

Demo Account

Fondex also offers a demo account loaded with virtual funds to make real-time transactions and refine a strategy on the cTrader platform. Demo accounts at Fondex expire if there is no activity for more than 90 days.

Deposits and Withdrawals

Fondex offers a wide range of payment methods, and both deposits and withdrawals are free.

Fondex charges no fees for deposits and withdrawals, and processing times are generally very fast across all funding methods:

- Visa/Mastercard/Maestro: No fees for deposits or withdrawals; deposits can be made in most currencies. Deposits are instant, and withdrawals are processed within 24 hours.

- Bank Transfer: No fees for deposits and withdrawals, though your bank may charge you a fee for the transfer. This is a EUR, GBP, or USD -only method of funding. Both deposits and withdrawals tend to take 1-3 business days.

- Webmoney: No fees for deposits or withdrawals in EUR and USD. Deposits are instant, and withdrawals are processed within 24 hours.

- B2BinPay: For those who wish to deposit in cryptocurrency, this funding method allows deposits and withdrawals in BTC, ETH, LTC, and BCH. Deposits take around 5 minutes to process, and withdrawals will take about 24 hours. No fees are charged.

Overall, Fondex offers a wide range of payment methods, no fees are charged for deposits or withdrawals, and processing times are quicker than the industry average.

Base Currencies (Trading Account Currencies)

Fondex offers a wider range of base currencies than is available at other brokers and offers accounts denominated in AUD.

The Fondex client portal allows traders to deposit funds in 9 currencies, including AUD, CAD, CHF, EUR, GBP, JPY, PLN, USD, and THB. British traders will be pleased that AUD is an option, as they will have bank accounts denominated in AUD and will be able to avoid paying currency conversion fees on deposits and withdrawals.

High-volume traders (who trade more than 10 lots a month) should consider opening an account denominated in USD because a conversion fee will be charged for every trade made on a USD-quoted currency pair. This can be done by opening a multi-currency bank account at a digital bank.

Overall, Fondex offers a wider range of base currencies than other brokers and offers accounts denominated in AUD.

Fondex Trading Platforms

Unlike other brokers that offer a range of platforms, Fondex’s platform support is limited to cTrader.

Fondex offers support for a single trading platform: cTrader. Advocates of cTrader will tell you that it is more beginner-friendly than MT4 and offers high-speed execution with a cleaner user interface.

Fondex cTrader comes with 70 pre-installed indicators, and cTrader Automate allows traders to build their own custom indicators or download them from the cTrader’s bot storefront. cTrader’s intuitive interface makes complex trade orders easy to manage, and it features multiple options for order execution, monitoring, and modification:

- Create an unlimited number of watchlists with your favourite instruments and store them in the cloud for easy access from any device.

- Use the Quick Trade tool for extra speed when opening, closing, and modifying orders.

- Fondex cTrader’s Market Depth lets you view the full availability of executable prices as they are streamed from our liquidity providers.

- Enter multiple orders and have them filled at once, with no queue.

- Access up to 50 fields of information on your deals, orders, and positions.

- Use Advanced Take Profit to define 1 to 4 levels of Take Profit and scale-out of your positions gradually.

- Activate Advanced Stop Loss to have your stop loss moved to a break-even level after the price has progressed a certain number of pips in your favour.

- Set price alerts to be notified when the price of an instrument reaches a certain point.

cTrader also comes complete with an advanced Copy Trading function, a real bonus for beginner traders. The copy trading strategy selection process is easy and straightforward:

- Assess all available strategies via an intuitive interface.

- Rank them according to profit percentage.

- Select the strategy that suits your profile and trading goals.

- Click ‘Start copying’, and all your trades will be executed automatically.

Overall, cTrader is a clean, modern, and feature-rich platform that all traders will enjoy using. The user base is smaller than MT4 or MT5, so tutorials and trading bots are not as prevalent online.

cTrader is available via your browser, as a desktop download for Windows PCs and for both Android and iOS devices for those that want to trade on the go.

Mobile Trading

Fondex’s mobile trading apps are limited compared to other brokers, with no mobile proprietary trading solutions.

As mentioned above, cTrader is available on both Android and iOS. The cTrader mobile app offers the best features available on the desktop version including the complete range of order types, trade analysis, and watchlists.

Trading Tools

Fondex’s trading tools are average compared to other brokers.

Besides the copy trading functionality built into the cTrader platform, Fondex has also partnered with Autochartist to offer its signals plugin.

Autochartist

Free for all Fondex clients, Autochartist is an award-winning automated technical analysis tool that plugs into cTrader and scans all available CFD markets for trading opportunities. This plugin combines standard technical analysis, chart analysis, and Japanese candlesticks and provides you with actionable information for all types of trading styles.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Autochartist is one of the best technical analysis tools on the market, and Fondex does well to offer this tool to its clients.

Fondex’s Financial Instruments

With over 1000 instruments available over seven asset classes, Fondex provides enough diversity to keep most traders satisfied.

Fondex offers trading on Forex, indices, shares, precious metals, energies, cryptocurrencies, and ETFs (click here for more on CFD trading).

-

Forex pairs: Fondex offers over 80 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is a much larger range than is typically available at other similar brokers.

- Indices: Fondes offers cash and futures contracts on over 15 international indices, including the NASDAQ, DAX, and FTSE100. This is an average range of indices compared to other brokers.

- Stock CFDs: Fondex’s stock CFD offering is impressive compared to most of its competitors, with 900 stock CFDs available to trade, including popular US tech companies, ASX stocks, those listed on the NASDAQ, NYSE, and more.

-

Precious metals: Fondex offers trading on 6 energies, including gold, silver, palladium, and platinum, which is around the average offered by most other brokers.

-

Energies: Fondex offers trading on 3 energies, including Brent Crude, Natural Gas, and Oil. This is average compared to most other brokers.

-

ETFs: Exchange Traded Funds have rapidly gained in popularity in recent years, and Fondex offers spot contracts on 18 of the most traded ETFs in the world.

-

Cryptocurrencies: Fondex offers a reasonably wide range of cryptocurrencies including Bitcoin, Ethereum, Dash, Ripple & Litecoin. Spreads on these currencies are variable and are significantly higher than Fiat currencies but in line with other brokers.

Overall, Fondex provides a larger range of tradable assets than most other brokers, including an impressive set of Forex pairs.

Fondex for Beginners

Fondex offers a welcoming environment for new traders, with a large (if unstructured) education section and a market news section that is updated daily.

Educational Material

Fondex’s educational materials are comprehensive and in-depth, but the information is not well-structured.

Fondex’s education section comprises a collection of articles covering everything from technical analysis and risk management to exit strategies and more general tips for successful trading. Though this section is unstructured, with no course for beginners, the material on offer is detailed and valuable. More experienced traders may find some of the articles helpful, too, with articles on scalping strategies and a deep dive into trading fundamentals.

Analysis Material

Fondex’s market analysis is updated frequently but is less comprehensive than what is available at other brokers.

Though Fondex provides a short market news section, it is updated frequently throughout the day. New articles are posted daily and are generally brief, though insightful. Fondex has also partnered with Autochartist, the world’s leading market analysis resource, to provide in-platform signals, technical analysis, and market news.

Customer Support

Fondex customer support is available 24/5 via live chat, phone, and email. Support is available in English, Russian, Arabic, French, Greek, and Malay. Fondex customer support and marketing is also active on social media and can be reached via Facebook, Twitter, LinkedIn, and Instagram.

For the purposes of this review, we found the live chat support responsive and polite. The live chat agents were also able to answer our questions satisfactorily.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Fondex offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Fondex would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

Fondex is one of the few brokers that offer the cTrader platform and the only broker we have come across that provides no other trading platform support. However, cTrader is a powerful and modern platform, packed full of features such as native copy trading and excellent automation options.

Fondex’s education and market analysis are largely unstructured, but provide a good introduction to Forex trading. It also charges much lower non-trading fees than other similar brokers. Overall, Fondex will not be for everyone, but cTrader converts and the curious may find it an interesting option.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come Fondex si posiziona rispetto ad altri broker.