Recensione del broker ACY Securities

Ultimo aggiornamento al Maggio 8, 2023

Il 75-90% dei trader al dettaglio perde denaro nel trading di Forex e CFD. Devi valutare se hai capito come funzionano i CFD e il trading con leva finanziaria e se puoi permetterti l’alto rischio di perdere il tuo denaro. Potremmo ricevere un risarcimento quando fai clic sui link ai prodotti che esaminiamo. Si prega di leggere la nostra informativa pubblicitaria. Utilizzando questo sito Web, accetti i nostri Termini di servizio.

Il nostro verdetto su ACY Securities

ACY has a large number of instruments on the MT4 and MT5 platforms and a variety of low-cost trading accounts, and we were pleased to find that Deutschs will benefit from local ASIC regulation.

ACY Securities’ commission-based accounts have spreads that start at 0 pips (EUR/USD) in exchange for commissions of between 5 and 6 USD, which is highly competitive. Experienced traders will also appreciate the wide range of instruments on offer, including 60+ Forex pairs and over 1600 share CFDs.

Overall, ACY Securities has excellent regulatory oversight, a range of low-cost accounts with a wide range of tradable assets, decent educational and market analysis materials, and a good selection of trading tools, making it a good option for Deutsch traders.

| 🏦 Deposito Minimo | USD 50 |

| 🛡️ Regolamentato da | ASIC, VFSC |

| 💵 Costo di Trading | USD 10 |

| ⚖️ Leva massima. | 500:1 |

| 💹 Copy Trading | Sì |

| 🖥️ Piattaforme | MT4, MT5 |

| 💱 Strumenti | Materie prime, Criptovalute, Stock CFDs, ETF, Forex, Indices |

Riepilogo generale

Informazioni sull'account

Condizioni di trading

Dettagli dell'azienda

Pro

- Ottima scelta di piattaforma

- Deposito minimo basso

- Ottimo supporto clienti

- Ampia gamma di asset

Controindicazioni

- Materiale formativo limitato

- Analisi di mercato limitata

Is ACY Securities Safe?

We consider ACY Securities a trustworthy broker because Deutsch traders are onboarded through its Deutsch-based entity, regulated by ASIC.

ASIC Regulation: Deutschs will be trading under the subsidiary, ACY Securities PTY Ltd (“ACY AU’), authorised by the Deutsch Securities and Investments Commission (ASIC).

Safety Features: Considered one of the best regulators in the world, ASIC mandates that all client funds are held in segregated accounts, separate from the company’s operational funds, and are afforded automatic negative protection. In order to protect traders, ASIC restricts leverage to 30:1 and bans all bonuses and promotions.

Company Details:

ACY Financial Instruments

ACY Securities has an impressive range of CFDs, more than is typically offered at other brokers.

See below for a list of ACY’s financial instruments and corresponding leverage:

- Forex: ACY Securities has over 63 currency pairs available for trading, a broader range than most other brokers. Major currencies include EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, and NZD/USD. Currency crosses are pairs where the US dollar is not the counter-currency. Some of the most popular and highly traded cross pairs include EUR/GBP, EUR/JPY, EUR/CHF, and GBP/JPY.

- Share CFDs: ACY securities offers 1,600 share CFDs, a broader range compared to other large international brokers. The selection available includes some of the major US, UK, and European Exchanges. Share trading is only offered on the MT5 platform.

- Indices: There are 17 indices available for trading at ACY Securities, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: ACY securities offers trading on 15 commodities, which is more than most other brokers. These include metals such as silver, gold, aluminium, and copper, and energies such as oil.

- ETFs: ACY Securities offers trading on 27 ETFs, an average range compared to other similar brokers. These include the most popular ETF CFDs such as the SPDR S&P500 ETF Trust, VanEck Vectors Gold Miners, and the Proshares UltraPro Dow 30 to name a few.

- Cryptocurrencies: Cryptocurrency CFDs are available on all of ACY Securities’ accounts. At the time of writing, there are 9 crypto/USD crosses available, including Bitcoin, Ethereum, Litecoin, and Ripple among others. The spreads vary significantly compared to other traditional Fiat currencies. It is not unusual for spreads to be as wide as 75 pips on Bitcoin, but cryptocurrency spreads vary greatly, so if you trade these currencies, watch your margins.

Overall, ACY Securities’ CFD offering is broader than other similar brokers, and it includes specialty CFDs such as ETFs and cryptocurrencies.

Accounts and Trading Fees

ACY Securities’ trading fees are average on its Standard Account but significantly lower than average on its ProZero and Bespoke accounts.

Trading Fees: ACY Securities offers three live accounts on the MT4 and MT5 platforms. The Standard Account has trading fees included in its variable spreads, while the ProZero and Bespoke accounts offer raw spreads (often down to 0 pips on the EUR/USD) in exchange for a commission per lot.

See below for more details:

ACY Securities’ Account Trading Costs:

As you can see from the table above, the trading costs on the Standard Account are built into the spread and are higher than the costs on the ProZero and Bespoke Accounts, which have a small commission per lot traded. However, the minimum deposit on the Standard Account is significantly lower than the requirements of the ProZero and Bespoke accounts.

Standard Account

The minimum initial deposit in the Standard Account is 50 USD. Spreads are variable, starting at 1.00 pips on the EUR/USD, which is slightly wider than similar-sized ECN/DMA brokers, but no commissions are charged.

ProZero Account

A minimum deposit of 200 USD is required to open a ProZero Account. Spreads start at 0.0 pips on the EUR/USD, and average at 0.1 pips, and a low commission of 6 USD (round turn) per lot is charged. These trading conditions are highly competitive for the industry.

On the ProZero Account, commissions are charged differently depending on the base currency of your account (this is detailed below).

Bespoke Account

A minimum deposit of 10,000 USD is required on this account, spreads start at 0.0 pips on the EUR/USD, and traders are charged a very low commission of 5 USD (round turn) per lot. Overall, the trading costs on this account are among the lowest in the industry.

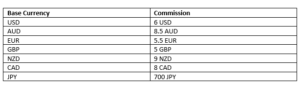

See the table below for the commissions in a selection of common base currencies:

MT4 and MT5 ProZero and Bespoke Account Commission Structure:

Overall, ACY Securities offers three live accounts which are suitable for beginners and more experienced traders. Its commission-based accounts also have some of the lowest trading costs in the industry.

Deposits and Withdrawals

ACY Securities offers a wide range of payment methods, and while deposits are free, some withdrawal methods incur a cost.

In line with Anti-Money Laundering policies, ACY Securities operates a “return to source policy,” meaning that withdrawals can only be returned to the original funding source.

Trading Account Currencies: ACY Securities offers accounts denominated in USD, EUR, GBP, AUD, NZD, CAD, and JPY, which is an advantage for Deutsch traders who will be able to avoid paying conversion fees on deposits and withdrawals. Conversion fees can make trading expensive, and affect profitability.

Deposits are free and instant. Withdrawal requests are processed on the same day if a request is received before 14:00 AEST. Requests received after 14:00 AEST might not be processed until the next business day.

See below for details:

Overall, ACY Securities offers a wide range of funding methods with fast processing times and fees only charged on some withdrawal methods.

Mobile Trading Platforms

With support for MT4 and MT5, ACY Securities’ mobile platform support is average.

MT4/MT5 Mobile Applications

Both trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options. In addition, spotty connections can reduce the overall trading experience. Generally, it is better to be at your desktop to conduct day-to-day trading and use a mobile device to keep an eye on the markets or close open positions.

Other Trading Platforms

Although ACY Securities only offers the Metatrader suite of platforms, which are not as beginner-friendly as the proprietary platforms offered at other brokers, MT4 and MT5 are considered some of the best third-party platforms in the industry. Additionally, ACY Securities offers the MetaTrader Scripts, one of the best MetaTrader plugins on the market.

Metatrader 4

While not the most beginner-friendly software, MT4 has been the industry-standard platform for trading Forex and CFDs since 2005. One of the features that make MT4 popular is its auto-trading feature that enables algorithmic trading and strategy backtesting with expert advisors (trading robots).

However, while MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

Metatrader 5

MT4’s successor, MT5, is a state-of-the-art, multi-functional platform that boasts advanced technical tools and copy-trading. MetaTrader 5 is designed to accommodate advanced trading across a wider selection of asset classes than its predecessor, MT4. Feature-rich, it boasts advanced tools and offers superior execution.

The benefit of ACY Securities offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, thousands of plugins and tools are available for both the MetaTrader platforms, some of which will be covered in the section below.

Trading Platforms Comparison:

Trading Tools

ACY Securities offers a small selection of trading tools to help traders make better trading decisions, but this includes MetaTrader Scripts, an excellent MetaTrader plugin.

ACY Securities has partnered with Capitalise.ai, Signal Start, and MetaTrader Scripts to provide traders with automated trading options.

-

- Capitalise.ai: This tool provides 24/7 market monitoring, indicating various trading opportunities and when traders should enter or exit a trade. It also provides a strategies library with a variety of live strategy examples to get you started.

- Signal Start: Signal start is essentially a copy trading service. It allows followers to choose from a wide range of strategy providers.

- MetaTrader Scripts: These are indicators that are designed to optimise your Forex trading. These include:

-

- MT4 Script Close All

- Delete all Objects

- Trading Statistics

- Trailing stop & Long Short

- Keltner Channel Indicator

- History Simulator

- Trend Ribbon

- Calculate Your Lots

- Donchian Channel

- Advanced Pivot Points

- Time Zone Indicator

Trading Tools Comparison:

Opening an Account at ACY Securities

ACY Securities’ account-opening process is as per the industry standard.

All Deutsch traders are eligible to open an account at ACY Securities as long as they meet the following minimum deposit requirements. These are:

- Standard account: 50 USD

- ProZero Account: 200 USD

- Bespoke Account: 10,000 USD

Traders can choose between a business or individual account, but for the purposes of this review, we will outline the process for opening an individual account:

- Click on the button at the top right-hand corner of the screen labelled “Open an Account.”

- Register a live account. This requires filling in a registration form with all your personal details including name, email address, and telephone number.

- The next step requires completing your personal details, including gender, ID number, date of birth, and residential address.

- Traders will then have to fill in their financial information, including employment details, occupation, and annual income. Traders will also have to select their preferred platform (MT4 or MT5), the base currency (click here for more on ACY Securities’ base currencies), account type, and leverage.

- Once this step is complete, clients are required to fill out a questionnaire that helps ACY Securities assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Traders will then have to verify that they have read the Key Information Statement, the Client Terms and Conditions, and the Privacy Policy Statement.

- ACY Securities requires at least two documents to accept you as an individual client:

- Proof of Identification – ACY Securities accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can log in and fund their accounts

Overall, ACY Securities’ account-opening process is fully digital and hassle-free and accounts are generally ready for trading once all documentation has been approved.

ACY Securities for Beginners

ACY Securities offers a wide selection of educational materials for beginner traders, but its market analysis materials are limited compared to other large international brokers. What is available is well-structured and of high quality. Customer support is also available 24/5 to help with any technical or account issues.

Educational Material

ACY Securities’ education section is comprehensive but not as good as the best brokers in this space.

ACY’s educational materials comprise e-books, trading videos, a video trading course, various articles about how to trade Forex, and a demo account. See below for more details:

- E-books: The in-house team of analysts has created a free trading e-book covering the essential aspects of trading, including ‘The Importance of Choosing the Right Company,’ ‘Forex Industry,’ ‘Fundamental Analysis,’ and ‘Technical Analysis,’ amongst others.

- Trading Courses: In this free trading series, ACY Securities’ Chief Market Analyst guides traders on how to apply chart patterns, how to trade according to the latest market events, and using fundamentals to make better trading decisions.

- Seminars and Webinars: These are run every Tuesday and Thursday evening in various languages by ACY Securities’ in-house market analysts. Webinars are free of charge to all visitors to the site but require registration.

- Articles: Various educational articles are published on a daily basis and cover topics such as leverage, how to use the Metatrader platforms, the basics of Forex trading, and more.

- Demo Accounts: ACY Securities’ demo accounts come loaded with up to 100,000 USD in virtual funds. Demos mimic the conditions on all of the above-mentioned accounts on both the MT4 and MT5 platforms. Demos last for six months and can be renewed on request.

Education Comparison:

Market Analysis Materials

ACY Securtities’ market analysis is limited compared to other similar brokers.

The market analysis section is updated on a daily basis but essentially comprises two sections – Market News and Market Analysis. Both sections cover articles written by ACY Securities’ in-house team of market analysts, headed by Duncan Cooper. The material is in-depth and well-structured.

Customer Service

ACY Securities is a service-oriented broker with multilingual support available 24 hours a day, 5 days a week through multiple channels. On opening an account, traders receive personalised support, helping them with account setup and any other technical difficulties. For the purposes of this review, we found the customer support responsive, polite, and resourceful.

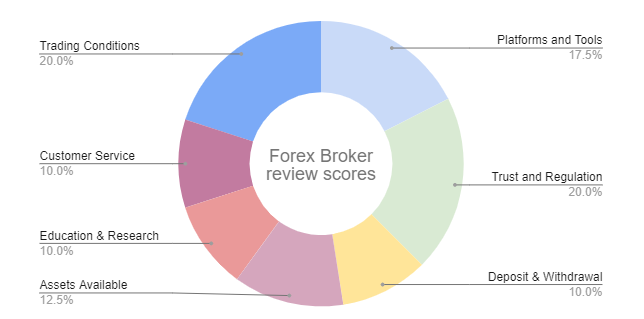

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of reliability, the platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. ACY Securities would like you to know that: Foreign exchange and derivatives trading carry a high level of risk. Before you decide to trade foreign exchange, we encourage you to consider your investment objectives, your risk tolerance, and your trading experience. It is possible to lose more than your initial investment, so do not invest money you cannot afford to lose. ACY Securities Pty Ltd ( AFSL: 403863) and ACY Capital Italia Limited (VFSC: 012868) provides general advice that does not consider your objectives, financial situation, or needs.

Overview

A trustworthy ECN/DMA broker, ACY Securities offers trading on over 1600 instruments, including over 60 Forex pairs. Trading conditions are excellent, with spreads down to 0.0 pips on two of its accounts, in exchange for low commissions. ACY also offers trading on the most popular platforms – MT4 and MT5, and it allows all trading strategies alongside a decent repository of educational materials. Overall, ACY Securities is a dependable, if unexciting CFD broker.

Team editoriale

Chris Cammack

Responsabile dei contenuti

Chris è entrato a far parte dell’azienda nel 2019 dopo dieci anni di esperienza nel campo della ricerca, della redazione e del design per pubblicazioni politiche e finanziarie. Il suo background gli ha dato una profonda conoscenza dei mercati finanziari internazionali e della geopolitica che li riguarda. Chris ha un occhio di riguardo per l’editing e un appetito vorace per l’attualità finanziaria e politica. Garantisce che i nostri contenuti su tutti i siti soddisfino gli standard di qualità e trasparenza che i nostri lettori si aspettano.

Alison Heyerdahl

Scrittrice finanziaria senior

Alison è entrata a far parte del team come scrittrice nel 2021. Ha una laurea in medicina con particolare attenzione alla fisioterapia e una laurea in psicologia. Tuttavia, il suo interesse per il forex trading e il suo amore per la scrittura l’hanno portata a cambiare carriera e ora ha oltre 8 anni di esperienza nella ricerca e nello sviluppo di contenuti. Ha testato e recensito oltre 100 broker e ha una grande conoscenza del mondo del trading Forex.

Ida Hermansen

Scrittrice finanziaria

Ida si è unita al nostro team come scrittrice finanziaria nel 2023. Ha una laurea in Digital Marketing e un background in scrittura di contenuti e SEO. Oltre alle sue capacità di marketing e scrittura, Ida ha anche un interesse per le criptovalute e le reti blockchain. Il suo interesse per il trading di criptovalute ha portato a un interesse più ampio per l’analisi tecnica e il movimento dei prezzi del Forex. Continua a sviluppare le sue competenze e conoscenze nel trading sul Forex e tiene d’occhio i broker Forex che offrono i migliori ambienti di trading per i nuovi trader.

Confronta i broker

Scopri come ACY Securities si posiziona rispetto ad altri broker.